Market Statistics

| Study Period | 2019 - 2032 |

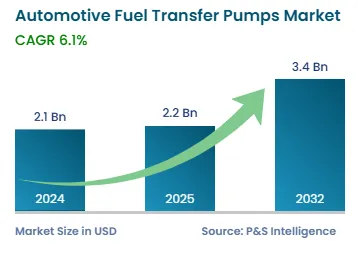

| 2024 Market Size | USD 2.1 Billion |

| 2025 Market Size | USD 2.2 Billion |

| 2032 Forecast | USD 3.4 Billion |

| Growth Rate (CAGR) | 6.1% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 10745

This Report Provides In-Depth Analysis of the Automotive Fuel Transfer Pumps Market Report Prepared by P&S Intelligence, Segmented by Pump Type (Fuel Supply, Fuel Injection, Engine Oil, Transmission Oil, Vacuum), Technology (Electrical, Mechanical), Vehicle Type (Passenger Cars, Commercial Vehicles, Heavy Vehicles), Sales Channel (OEM, Aftermarket), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 2.1 Billion |

| 2025 Market Size | USD 2.2 Billion |

| 2032 Forecast | USD 3.4 Billion |

| Growth Rate (CAGR) | 6.1% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

|

Explore the market potential with our data-driven report

The automotive fuel transfer pumps market size stood at USD 2.1 billion in 2024, and it is expected to grow at a CAGR of 6.1% during 2025–2032, to reach USD 3.4 billion by 2032.

The market is witnessing healthy growth on account of the burgeoning automotive industry. Moreover, recent advancements, such as interactive safety systems, self-driving cars, and automobile connectivity, are expected to change the global scenario of the automotive industry over the forecast period.

The ability of these components to efficiently push the fuel into the engine is expected to drive their demand in the coming years. In addition, owing to the increasing demand for vehicles due to people’s rising income, which eventually boosts their purchasing power, the demand for fuel transfer pumps is burgeoning. Additionally, the changing customer preferences regarding the usage of fuel more efficiently are expected to drive the market growth.

The demand for automotive fuel transfer pumps is increasing on account of the rising use of high-pressure fueling systems for heavy machinery, including construction equipment, trucks, and plant equipment. In addition, the rising use of automotive fuel transfer pumps in light and heavy commercial vehicles, passenger cars, and other vehicles drives the market growth.

The electric category dominated the market in 2024, with 70% share, and it will also witness the higher CAGR during the forecast period. This is because of their better performance and higher efficiency of electric pumps than mechanical ones.

Moreover, electric pumps offer various benefits, such as enhanced pressure regulation, a lower risk of wear and tear, and high durability. These devices are proficient in operating at pressures between 30 and 40 pounds per square inch. Automobiles featuring advanced injection systems use such pumps as these components are quite safe and supply fuel to the engine efficiently, with a low power loss. Electric vacuum fuel transfer pumps also help in the reduction of carbon dioxide emissions from engines.

Therefore, the adoption of electricity-based injecting machines is comparatively high, resulting in an increment in the automobile price. With the growing awareness about the benefits, consumers are demanding automobiles equipped with electric pumps for gasoline transfer. Hence, the majority of the vehicles nowadays are equipped with this component, and this trend is likely to continue over the forecast period.

Moreover, gasoline direct injection is an innovative technology that is progressively replacing the gasoline port injection technology due to the steep rise in the adoption of novel technologies by automotive manufacturers to comply with the stringent emission norms across the globe and achieve the desired fuel economy.

This is primarily on account of the improved combustion and mechanical efficiency offered by this technology, which lead to an improved automotive performance and lower vehicular emissions. Manufacturing giants offering gasoline direct-injection engines include General Motors, Hyundai Motor Company, Ford Motor Company, BMW AG, and Volkswagen of America Inc.

On parallel lines, automakers are launching commercial vehicles with diesel direct-injection systems, owing to their high efficiency and superior performance.

The segment is bifurcated as below:

The passenger car category dominated the market in 2024 as fuel transfer pumps are being increasingly used to improve the fuel efficiency and performance of passenger cars. This was also due to the strong economic growth, rising disposable income, favorable demographics, and adequate financing availability.

Commercial vehicles are the fastest-growing category with 7% CAGR during the forecast period. This is attributed to the increasing sale of buses for public transportation and trucks for freight haulage. As per OICA, sales of commercial vehicles rose from 24,226,493 units in 2022 to 27,452,301 units in 2023. Since these vehicles are built for higher loads, they are integrated with more-powerful engines, which require more fuel. This propels the demand for fuel pumps that offer higher efficiency both in terms of the volume of fuel transferred and energy consumed.

These vehicle types were analyzed:

Fuel supply pumps dominate the market with 45% value share in 2024. This is attributed to the high sale of conventional ICE vehicles and the rising popularity of HEVs and PHEVs. As per research, PHEV sales could reach 9.9 million units in 2030, rising from 4.3 million units in 2024 at a robust 14.9% CAGR.

Vacuum pumps are the fastest-growing category as they are used for a number of purposes in a four-wheeler, including central locking, air conditioning systems, and exhaust gas recirculation. Hence, the growing demand for cars, buses, and trucks with these advanced features and those that offer higher occupant comfort will drive this category in the future.

These pump types have been covered:

OEMs will continue to dominate the market till 2032 on account of the burgeoning sale of automobiles around the world. An array of fuel transfer pumps are integrated into vehicles during the manufacturing and assembly process, which makes OEMs the larger buyer of these components from tier-1 and tier-2 suppliers.

The aftermarket would witness the higher value CAGR during the forecast period, of 7.5%. This is attributed to the increasing operational age of vehicles, which drives the demand for and is a result itself of frequent component replacement and efficient servicing. According to the Bureau of Transportation Statistics, the average age of passenger cars in the U.S. rose from 13.6 years in 2023 to 14 years in 2024, while the average ages of light trucks for these years stood at 11.8 years and 11.9 years, respectively.

Over buying from the OEM, having the pump replaced by a vehicle repair garage is cheaper and quicker. These entities also give customers are wider choice of pumps by numerous manufacturers. Even many people who chose to replace fuel transfer pumps themselves buy from the aftermarket, rather than the manufacturer itself.

We studied the below-mentioned sales channels:

Drive strategic growth with comprehensive market analysis

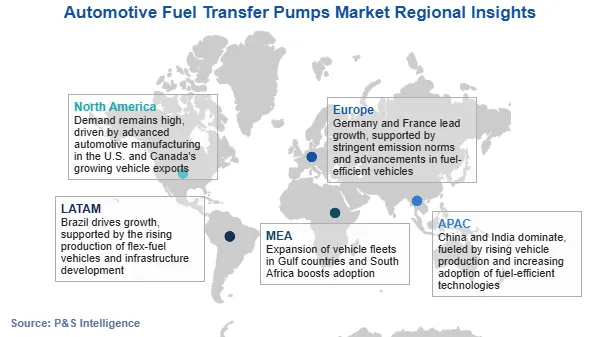

APAC is the largest and fastest-growing market with 40% share in 2024 and 8% CAGR till 2032, respectively. The expansion of the automotive sector in China has drawn the attention of various international automakers. Home to the largest auto sector in the world, the country continues to witness a boom in the integration of components that transfer fuel from the tank to the engine. Moreover, the country's rapid embrace of hybrid vehicles has created a rise in car sales, which offers an appealing potential to auto component makers in China.

The encouragement given to the production of hybrid vehicles has also made a significant contribution to the growth in the integration of such pumps. The Ministry of Industry and Information Technology of China has issued regulations that allow automakers to manufacture more petrol–electric hybrids and fewer all-electric automobiles, which are more expensive, between 2021 and 2023. In an effort to boost the usage of such automobiles, while lowering pollution, the government also provides tax exemptions on their purchase.

Furthermore, component sales in the APAC region are primarily influenced by the renting and reselling of automobiles. As a result, auto parts companies are actively strengthening their supply chains, particularly in North America and APAC. Suppliers are catering to the specific requirements of automakers by focusing on developing high-quality automotive pumps that adhere to the prevalent emission and efficiency regulations. Most of the suppliers have long-term contracts with OEMs for such components, in order to ensure a steady inflow of revenue and stay relevant amidst the intense competition.

Additionally, it is predicted that the demand for fuel transfer pumps in the Middle East and Africa region will expand at a high rate over the next few years. The increasing expenditure on technological advancements and the soaring demand for passenger cars and light commercial vehicles are contributing to the rapid expansion of the domain in this region. Middle Eastern governments also have created policies to encourage financial investments in the auto sector. In the same way, the mining and industrial sectors are forecast to boost the sales of light and heavy commercial vehicles in the MEA region, thus propelling fuel transfer pump sales.

Moreover, in 2024, Europe was the second-largest buyer of such components. This was due to the presence of giant automakers in Europe, which is also expected to have a positive effect on the industry during the projection period. This would be, in part, due to a surge in the demand for green vehicles, such as conventional hybrids and PHEVs, in Germany, France, and Italy. Additionally, the presence of numerous automobile giants in European countries, such as Germany, France, and Italy, and the growing hybrid passenger vehicle preference are projected to augment the growth in component sales in this region.

Moreover, countries such as Brazil and Mexico are expected to contribute significantly to the LATAM automotive industry.

Here is the regional breakdown of the market:

The market for automotive fuel transfer pumps has a CAGR of 6.1% during 2025–2032.

The automotive fuel transfer pumps industry is led by the electric category.

APAC is the fastest-growing the market for automotive fuel transfer pumps.

Emission norms, urbanization, and rising car sales are the key drivers for the automotive fuel transfer pumps industry.

The market for automotive fuel transfer pumps is fragmented.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages