Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 13.6 Billion |

| 2025 Market Size | USD 15.2 Billion |

| 2032 Forecast | USD 36.3 Billion |

| Growth Rate (CAGR) | 13.2% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 10557

This Report Provides In-Depth Analysis of the Automotive Sunroof Market Report Prepared by P&S Intelligence, Segmented by Material (Glass, Fabric), Vehicle Type (Premium and Luxury Cars, SUVs, Sedan Cars, Hatchbacks), Product Type (Inbuilt, Spoiler, Panoramic, Pop-Up), Operation Type (Electric, Manual), Propulsion (ICE, Electric), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 13.6 Billion |

| 2025 Market Size | USD 15.2 Billion |

| 2032 Forecast | USD 36.3 Billion |

| Growth Rate (CAGR) | 13.2% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

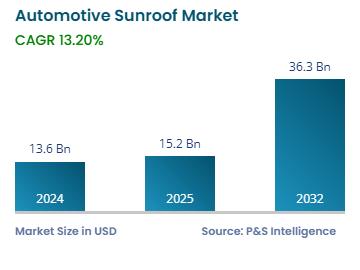

The global automotive sunroof market values stood at USD 13.6 billion in 2024, which is predicted to rise to USD 36.3 billion by 2032, growing at a CAGR of 13.2% between 2025 and 2032. The growth is ascribed to the rise in automotive manufacturing, increase in per capita income, and growth in the pace of the technological advancements in sunroof systems.

Moreover, the increasing sales of passenger vehicles and rising consumer expenditure on brighter vehicle interiors and better ventilation, to improve the driving experience, are expected to fuel the demand for automotive sunroofs. These components are becoming more popular as customer preferences move toward a better driving experience. Another important factor that helps in the market growth is the increasing tendency among manufacturers to provide these components as an optional feature in the majority of the passenger cars.

The demand for such auto parts is also projected to be driven by the technological developments in their materials and designs, to improve safety, performance, and aesthetics and reduce the failure rate. This is due to the center of gravity being altered when certain heavy glasses are installed in a car's sunroof system, which compromises the vehicle stability and structural integrity. In order to minimize weight and ensure stability, continual design improvements and material developments are being brought about.

Sport utility vehicles are one of the most-popular car classes because of their high variation in range, power output, and amenities and high adaptability on rough terrain. In the coming years, SUVs are expected to see significant acceptance, particularly in emerging economies, such as China and India. As a result of these considerations, automakers, such as Ford, Chevrolet, Kia, and Toyota, have been pushed to adopt sunroofs in their vehicles. Furthermore, Audi Q3, Q7, and BMW X3, X5, and X6 are among the new, popular SUV models equipped with panoramic sunroofs.

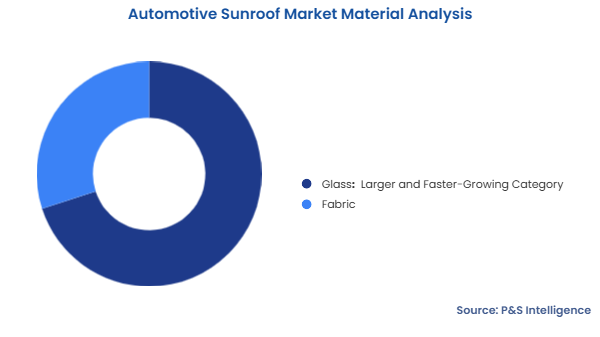

Glass variants held the major revenue share in 2024, of 70%, and they will witness the higher CAGR over the coming years. This is attributable to technological improvements, which have enabled the production of numerous types of glassware, such as tempered glass, laminated glass, and glass that can protect against UV radiation. Unlike fabric sunroofs, which are frequently seen on convertibles, those made of glass allow users to better regulate natural light and enjoy natural ventilation, rather than depending solely on the car's AC.

These materials have been studied:

Premium and luxury cars held the largest market share in 2024, owing to the increasing spending power of the consumers in emerging economies, as well as in developed countries, such as the U.S., the U.K. Germany, Italy, France, and Spain. The early adoption of sunroofs in advanced economies is largely credited to luxury automobile OEMs’ emphasis on enhancing the whole travel experience and comfort of the vehicle.

The automotive sunroof market is expected to witness the fastest growth in the sedan car category during the forecast period, of 15%. This would primarily be due to the increasing adoption of sunroofs in mid-segment cars, along with high-end and sports cars. Due to the changing consumer preferences, the majority of sedan manufacturers are coming up with sunroofs mounted on their vehicles, as an add-on feature in the more-expensive models, as well as in standard models.

Moreover, class E and class F automobiles, which include mid-size and full-size luxury sedans, have the highest number of premium models across OEMs. These cars often come with a wide selection of luxurious and comfort-inducing amenities, including sunroofs, which improve the customer's entire travel experience. In this regard, the early adoption of sunroofs by numerous upscale automobile manufacturers worldwide has greatly helped in driving the market growth.

We analyzed these vehicle types:

The panoramic category dominates the market with 55% share in 2024, and it is also the fastest-growing category. This is attributed to the larger area of this variant, which ensures fresh air and sunlight both in the front and rear of the cabin. Moreover, panoramic sunroofs have now become standard offerings in premium cars, which is a key reason for the dominance of this category.

These product types were studied:

The electric bifurcation holds the larger share, and it will also witness the higher CAGR, of 16%, over the forecast period. These variants offer higher convenience than manual ones as they can be controlled via pushbuttons on the steering console. The elimination of the need for someone to stand up and open a manual sunroof also reduces distractions for the driver, thus enabling higher passenger safety. Further, with mobile connectivity features becoming common in high-end cars, the sunroof can be controlled via a smartphone app, offering added convenience.

These operation types are part of the research scope:

The ICE category holds the largest share, of 65%, simply because more ICE vehicles have been manufactured till now than electric ones. Even in contemporary times, more units of conventional automobiles are manufactured than electric ones because gasoline (petrol), diesel, CNG, and other fossil fuels are more-readily available than public and private EV charging stations. ICE vehicles have been around for over a century, which is why they are a lot more affordable than EVs.

The electric category will witness the higher CAGR during the forecast period, attributed to the growing emission concerns around the world. Additionally, the implementation of stringent emission regulations is making ICE vehicles costlier, while subsidies and other financial incentives are resulting in reducing EV prices. As per the International Energy Agency (IEA), 14 million electric cars were sold worldwide in 2023, which means 1 in 5 cars sold last year was electric.

These propulsions have been covered:

Drive strategic growth with comprehensive market analysis

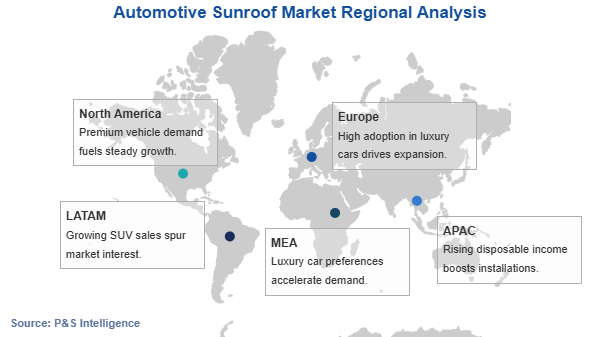

The Asia-Pacific region accounted for the largest market share in 2024, of 55%, and it is projected to grow at the highest CAGR, of 15%, over the next few years. This growth is attributed to the rising demand for premium vehicles, coupled with the increasing disposable income of the consumers in emerging economies, such as China and India. AS per studies, China, India, and Japan are three of the world’s largest automotive markets by sales volume. Additionally, the growing investment by automotive manufacturers to optimize their production capacity across the region is driving the market growth.

Furthermore, the presence of major automotive OEMs, such as Suzuki, Hyundai-Kia, Mitsubishi, Toyota, Lexus, and Tata Motors; growing preferences for vehicle personalization, and rising demand for post-sale sunroof installation from the younger population are some other factors propelling the growth of the market.

Additionally, governments in the Asia-Pacific region are launching programs to advance the automobile industry, which will help in the growth of the related markets. The rising demand for mass-segment automobiles, with sunroofs as an optional feature, and the government attempts to promote the use of electric vehicles are to credit for the growing demand for these auto parts. For instance, the Indian government has announced a number of subsidies for EVs, to encourage manufacturers to increase their output over the forecast period.

Furthermore, Europe was the second-largest market for automotive sunroofs in 2024, and it is expected to grow at a substantial CAGR in the coming years. This is majorly due to the growing popularity of premium vehicles and strong tendency of OEMs to integrate extra features to improve comfort and the driving experience. Moreover, the region serves as a hub for major luxury automakers, especially Germany, which is home to Volkswagen, BMW, Audi, and Daimler.

Below the geographical breakdown of the market:

Premium and luxury cars dominate the market for automotive sunroofs.

Sunroofs integrated with solar panels are a key automotive sunroof industry trend.

During 2025-2032, the market for automotive sunroofs will have a CAGR of 13.2%.

The automotive sunroof industry is fragmented.

APAC is the largest market for automotive sunroofs, led by the rising auto sales in China and India.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages