Crop Protection Chemicals Market Analysis

Explore In-Depth Crop Protection Chemicals Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 12343

Explore In-Depth Crop Protection Chemicals Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

The sales of herbicides will generate the highest revenue, around USD 35 billion, in 2024 in the market and also grow the fastest. They are used to manipulate or control undesirable vegetation and promote the growth of desirable species. Moreover, these chemicals are most common in row-crop farming, in which these are used prior to or even during planting to enhance crop production while reducing other vegetations.

Also, these chemicals are utilized in forest management to prepare logged areas for replanting and applied on water bodies to control aquatic weeds. Due to the vast application base, these chemicals account for the largest revenue share in the market. Furthermore, the growth in demand for herbicides can be ascribed to the fact that adjuvants in the agricultural sector envisage high economic advantages to farmlands and agricultural installations, and their high-volume consumption across the globe.

Insecticides are other important crop protection chemical. These are extensively applied in the production of staple crops, due to their susceptibility to insect infestation. The development of integrated pest management strategies in industrialized nations has significantly reduced farmers' reliance on insecticides. However, their demand is projected to be high throughout developing nations.

The following types are covered:

The cereals and grains category is largest revenue contributor to the crop protection chemicals market, and it will advance at the highest CAGR, of 6% during 2025–2032. The rising demand for food stock for the massive population is a key factor behind the cultivation of cereals on a large scale. Cereal production has increased significantly in this decade, as people become more conscious of the importance of maintaining a healthy lifestyle and fulfilling their dietary needs.

Furthermore, with the rising global population, along with the scarcity of land for crop cultivation, there is an increased pressure to maximize the crop yield, primarily cereals and grains, from existing farmlands and agricultural installations. Moreover, in order to consume the required nutrition, the demand for cereals is rising at a significant rate. Thus, these factors are propelling the market growth.

We have analyzed these crop types:

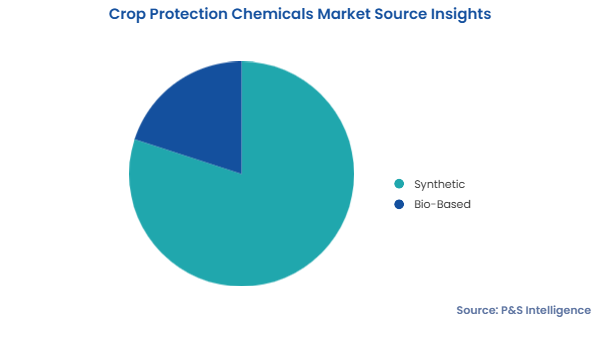

The synthetic bifurcation dominates the market with 80% revenue share. This is attributed to the easy availability of chemical-based crop protection chemicals in bulk and at reasonable prices with all large and small players in the market. Moreover, most of the local retailers and wholesalers keep sufficient stocks of synthetic agrochemicals as most farmers know about them.

The bio-based bifurcation will witness the fastest-growth in the market during the forecast period. This is because of the increasing awareness of the harms of chemical-based chemicals on plants and soil. Additionally, the shifting focus on sustainable and organic agriculture propels the consumption of crop protection chemicals made from bio-based sources. As a result, all major chemical companies are increasing their production of the said chemicals to meet the market demand and differentiate themselves from competitors.

The scope covers the below-mentioned sources:

The liquid bifurcation holds the larger share, and it will also have the higher CAGR, of 6.5%, over this decade, as liquid chemicals are easier to apply. All farmers need to do is fill it in a tank in the desired concentration with the required additives and spray it via a nozzle on the desired area. These formulations enable better farm area coverage and higher effectiveness, thus offering optimum cost-to-yield benefits.

The segment is bifurcated as below:

The foliar spray category holds the largest share, by value, of 45%, in 2024. This is because spraying the leaves is the easiest and oldest-known method of applying crop protection chemicals. The easy availability of liquid chemicals and spray tanks makes this method highly accessible around the world. Moreover, for more effectiveness and higher area coverage, drones or small aircraft are often used for spraying these chemicals in developed countries.

Seed treatment will witness the highest CAGR over the forecast period because of the convenience it offers to the agrarian community. Seeds can be bought pre-treated from agrochemical companies or agricultural co-operatives or treated by farmers themselves onsite. This one-time procedure reduces the need for regular application of crop protection chemicals after sowing, thus helping save on time, effort, and money. Moreover, applying the chemicals directly to seeds can offer higher effectiveness and ensure optimal plant growth.

The report offers insights into these modes of application:

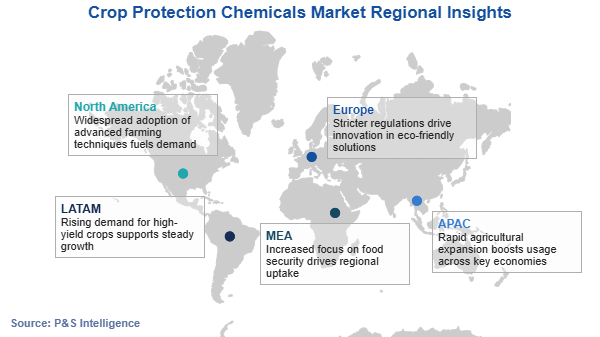

The APAC crop protection chemicals market accounts for the largest revenue share, of 35%, in 2024, and it is further expected to witness the same trend during the forecast period. This is ascribed to the substantial agricultural base, extensive farmland, and rise in awareness of pesticide use, in the region. Furthermore, the regional market expansion is fueled by technical advancements in the field of agriculture and rise in demand for crops and their cultivation throughout the region.

The APAC market is also expected to demonstrate the fastest growth during the forecast period, of 7.5%, primarily on account of the rapidly increasing usage of such agrochemicals in developing countries. China and India are the two most populous nations in the world, and accounted for around 19.0% and 18.0% of the global population, respectively, as of 2020. Furthermore, by 2050, these countries are expected to add an additional 2.3 billion people to the global population. The increase in population is expected to stimulate the demand for food, to meet the per capita food and nutritional requirements, which, in turn, will boost the market at a rapid pace.

Below is the regional breakdown of the industry:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages