Diaphragm Pumps Industry Insights

Mechanism Insights

The air-operated category will hold the larger market share, of 65%, in 2024.

- These AODD pumps are most suited for the mining and chemical sectors, where there is a greater risk of explosions, and even a small electrical issue might result in significant damage.

- Moreover, these pumps have low operational and maintenance costs.

- The electrically operated category will grow at the faster CAGR, of 5.0%, in the forecast period.

- These electric pumps, known for precise control of pressures and flow rates, are in high demand across various industries for their efficiency in fluid dispensing and dosing.

The mechanisms included in this report are:

- Air Operated (Larger Category)

- Electrically Operated (Faster-Growing Category)

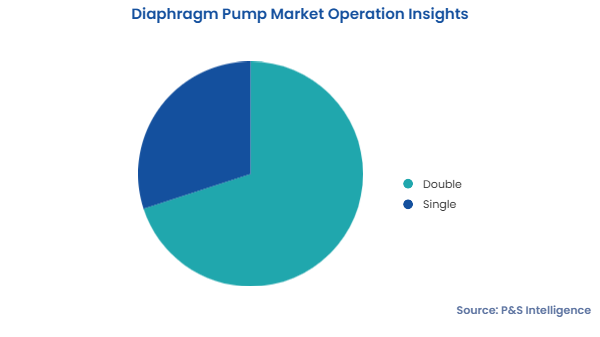

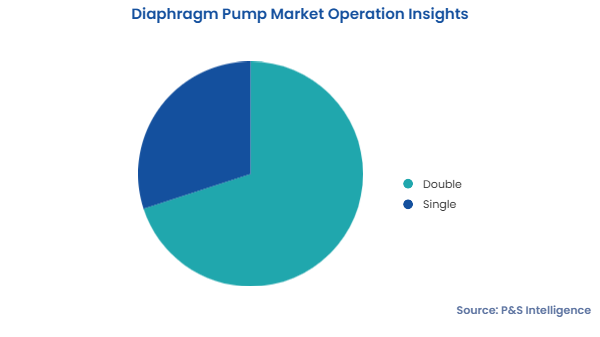

Operation Insights

- The double-acting category will hold the larger market share, of 70%, in 2024 due to being energy-efficient.

- These pumps function by alternating, which reduces pulsation and produces a steady, even flow.

- Moreover, these pumps are ideal for high-pressure applications because they distribute the load evenly, lowering the strain and extending the lifespan of the pump.

- The single-acting category is expected to grow at a higher CAGR, of 4.0%, in the forecast period.

- These pumps need less power to operate as they work on only one diaphragm moving fluid per cycle.

- Moreover, these pumps have a simple design which helps in lowering the percentage of components that can fail or wear out, making them durable.

- These pumps are also cost-efficient due to their simple design which makes them less complex and lowers their maintenance costs.

The operations included in this report are:

- Single (Faster-Growing Category)

- Double (Larger Category)

Discharge Pressure Insights

- The up to 80 bars category will hold the largest market share, of 55%, in 2024.

- These pumps are widely used in several industries, such as food & beverage, water treatment, and pharmaceutical, due to their versatility.

- Because these pumps do not require high pressure, they also satisfy the regulatory norms for environmental safety, which has led to their widespread use in a variety of industries.

- The above 200 bars category is expected to grow at the highest CAGR, in the forecast period.

- These pumps have high demand in heavy industries, such as petrochemicals and oil and gas, because they can handle extreme pressures, ensuring reliable performance.

- The technological advancements in these pumps have made them more durable, efficient, and reliable, resulting in their increasing adoption in industries that subject these pumps to extreme workloads.

The discharge pressures included in this report are:

- Up to 80 Bars (Largest Category)

- 81−200 Bars

- Above 200 Bars (Fastest-Growing Category)

End Use Insights

- Water & wastewater will hold the largest market share, of 35%, in 2024 due to the high demand for clean and safe water.

- Diaphragm pumps are significant in keeping water safe and clean as they can handle abrasive and corrosive fluids.

- Moreover, these pumps can handle several chemicals that are used in treating the water, such as acids and chlorine.

- The government regulations and international guidelines to ensure a safe and clean environment also play a significant role in these machines’ popularity by encouraging the expansion of the wastewater treatment infrastructure.

- Pharmaceuticals are expected to grow at the highest CAGR, of 6.0%, in the forecast period.

- The pharmaceutical sector places great importance on sterilize-in-place (SIP) and clean-in-place (CIP) procedures, for which these diaphragm pumps are ideal.

- These pumps can fulfill hygiene needs as they can prevent cross-contamination due to hermetic sealing.

The end uses included in this report are:

- Water & Wastewater (Largest Category)

- Oil & Gas

- Chemicals

- Pharmaceuticals (Fastest-Growing Category)

- Food & Beverages

- Power & Energy

- Others

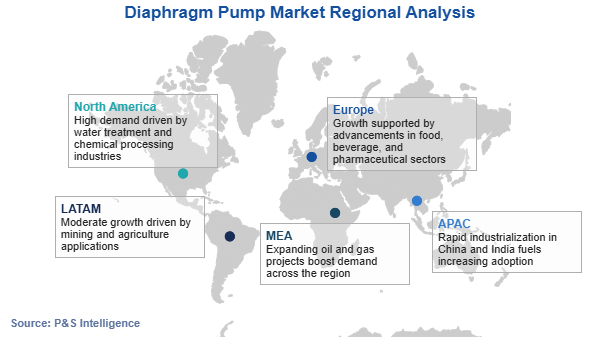

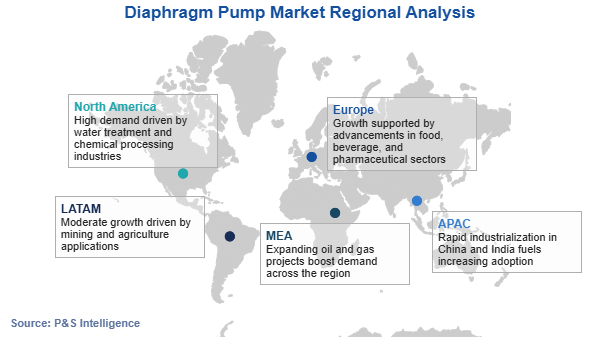

Regional Analysis

- The Asia-Pacific region will hold the largest market share of 40% in 2024 and witness the highest CAGR, of 5.0%, in the forecast period.

- The region's numerous chemical and pharmaceutical plants drive a high demand for diaphragm pumps.

- The adoption of new technologies in this region is also increasing, which helps in enhancing the capabilities and performance of these pumps.

- China and India face acute water scarcity, which compels their governments to set up wastewater treatment plants, thereby driving the demand for diaphragm pumps.

The countries and regions analyzed in this report are:

North America

- U.S. (Larger and Faster-Growing Market)

- Canada

Europe

- U.K. (Fastest-Growing Country Market)

- Germany (Largest Country Market)

- France

- Italy

- Spain

- Rest of Europe

Asia Pacific (APAC) (Largest and Fastest-Growing Regional Market)

- China (Largest Country Market)

- India (Fastest-Growing Country Market)

- Japan

- South Korea

- Australia

- Rest of APAC

Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa (Fastest-Growing Country Market)

- U.A.E.

- Rest of MEA