Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 49.6 Billion |

| 2025 Market Size | USD 51.2 Billion |

| 2032 Forecast | USD 67.3 Billion |

| Growth Rate (CAGR) | 4% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

Report Code: 12129

This Report Provides In-Depth Analysis of the Phosphoric Acid Market Report Prepared by P&S Intelligence, Segmented by Application (Diammonium Hydrogen Phosphate, Monoammonium Dihydrogen Phosphate, Triple Superphosphate), Grade (Food, Agricultural, Industrial), End Use (Fertilizers, Feed and Food Additives, Industrial Products, Detergents, Water Treatment Products, Metal Treatment Products), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 49.6 Billion |

| 2025 Market Size | USD 51.2 Billion |

| 2032 Forecast | USD 67.3 Billion |

| Growth Rate (CAGR) | 4% |

| Largest Region | APAC |

| Fastest Growing Region | APAC |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

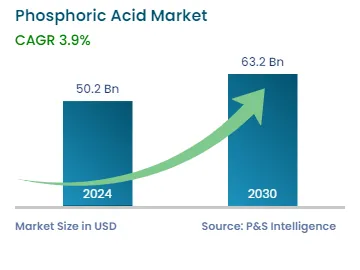

The global phosphoric acid market was USD 49.6 billion in 2024, and the market size is predicted to reach USD 67.3 billion by 2032, advancing at a CAGR of 4.0% during 2025–2032.

The market is driven by the growing demand of fertilizers. The production of phosphate-based fertilizers such as DAP and MAP requires phosphoric acid as an essential component to enhance soil productivity. Rising global population numbers require extra food production capacity to fulfill rising food requirements. The growing levels of agricultural production directly increase the market need for phosphoric acid since it functions as a vital component in fertilizer manufacturing. The primary use of this compound is in creating phosphate fertilizers which play a crucial role in boosting soil fertility and agricultural productivity. The government activities in India and China designed to increase agricultural productivity enhance the market demand for phosphoric acid. The developing agricultural sectors of these areas require phosphoric acid for manufacturing high-quality fertilizers that support sufficient food cultivation.

Phosphoric acid functions as an acidity regulator and preservative within the food industry, appearing frequently in soft drinks and processed foods. The production processes for detergents, water treatment solutions, and metal surface treatments utilize this compound. The resource quantity stands at 05 million tonnes while West Bengal contributes 57% and Jharkhand provides 30% of these resources.

The European Union permits the use of phosphoric acid and its phosphate derivatives as food additives according to certain regulatory standards. These compounds have undergone re-evaluation by the European Food Safety Authority (EFSA) to confirm their safety for food use. The EFSA's 2019 assessment determined that medical-purpose formulas with phosphates presented no safety issues for infants under 16 weeks old, yet phosphate exposure from food additives could surpass safe thresholds for many Europeans.

The diammonium hydrogen phosphate category held the largest market share, of 55%, in 2024, because of its high nutrient value and general use in agriculture. DAP has both nitrogen and phosphorus, which makes it a priority fertilizer for most crops. It is extensively applied in Asia-Pacific, especially in China and India, where massive agricultural production fuels strong demand. Also, government subsidy on phosphate fertilizer in most developing countries further perpetuates the hegemony of DAP. With its high solubility and versatility, farmers find it most suitable, reasserting itself as the biggest application.

The monoammonium dihydrogen phosphate category will grow at a higher CAGR, of 4.5%, during the forecast period, fueled by its high phosphorus content efficiency and increasing use in precision agriculture. MAP offers a higher phosphorus concentration in a soluble form, which is best suited for contemporary farming practices such as fertigation and controlled-release fertilizers. The growing emphasis on sustainable and high-efficiency fertilizer particularly in areas with declining soil quality has increased MAP demand. Moreover, environmental issues regarding high levels of fertilizer runoff are causing a turn towards fertilizers based on MAP, which provides superior nutrient uptake and environmental suitability.

The applications analyzed here are:

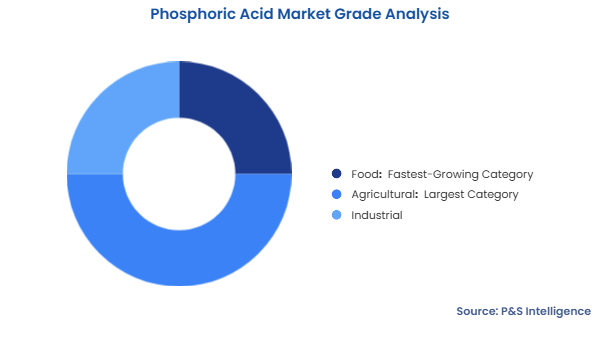

The agricultural category held the largest market share, of 50%, in 2024, with fertilizer manufacturing taking up most of the world's phosphoric acid consumption. The grade is an important raw material in producing phosphate fertilizers like diammonium phosphate (DAP), monoammonium phosphate (MAP), and triple superphosphate (TSP), which find extensive application in making soil fertile and increasing crop yield. Large-scale farming countries like China, India, and Brazil dominate the demand for phosphoric acid in the agricultural grade. Government subsidies and policies that favor the usage of fertilizers.

The food grade category will grow at a higher CAGR, of 5%, during the forecast period, due to rising demand within the food and beverage sector. It is extensively used as a food additive to regulate acidity, improve flavor (particularly in carbonated soft drinks such as colas), and as a processed food preservative. As consumption of processed and convenience foods, especially in emerging economies such as India and China, increases, demand for food-grade phosphoric acid is increasing. Further, stringent food safety regulations in countries such as North America and Europe are creating the need for high-purity food-grade phosphoric acid, thereby fueling its growth.

The grades analyzed here are:

The fertilizers category held the largest market share, of 35%, in 2024, because it is a major constituent of phosphate-based fertilizers monoammonium phosphate (MAP) and diammonium phosphate (DAP), which play a crucial role in boosting farm productivity. The world's major agricultural countries, including China, India, and Brazil, are fueling this demand because they need to use fertilizers to boost production and maintain food supplies for the increasing populations of these countries. Government subsidies and farm policies in most countries also promote the usage of phosphate fertilizers, thus supporting this sector's stronghold.

The water treatment products category will grow at a higher CAGR, of 6%, during the forecast period, due to escalating worldwide interest in water quality, industrial wastewater management, and environmental sustainability. Phosphoric acid finds extensive application in municipal and industrial water treatment for corrosion prevention, pH correction, and pipeline and boiler scale protection. Urbanization and rapid industrialization in Asia-Pacific and North America have heightened the demand for effective and sustainable water treatment. In addition, stringent government policies regarding wastewater treatment and pure drinking water in countries such as Europe and U.S. are driving the use of phosphoric acid in this industry, propelling its high growth rate.

The end uses analyzed here are:

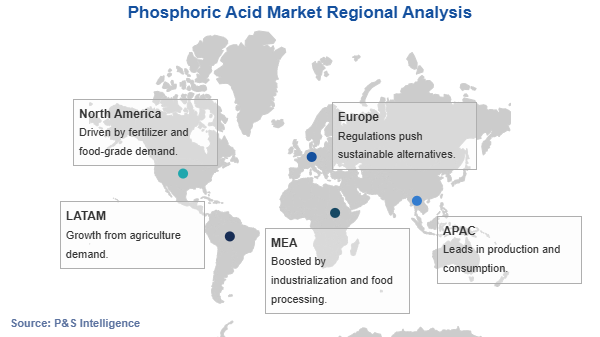

Drive strategic growth with comprehensive market analysis

The APAC region held the largest market share, of 40%, in 2024, and will grow at a higher CAGR, of 5.5%, during the forecast period, as it is driven by dominance in agriculture, rapid industrialization, and rising food demand. China and India, among other nations, are dependent on phosphate-based fertilizers to sustain their huge agricultural economies and address their booming population's food needs. China is particularly the largest producer and consumer of phosphoric acid globally, controlling about 50% of the world market share as of 2022. This is driven by China's huge phosphate rock reserves, bulk production of yellow phosphorus, and large phosphate fertilizer industry. The area is anticipated to experience the quickest growth in the market, recording a significant rise in regional production of phosphoric acid during the forecast period. Being largely agrarian economies, China and India will propel increased crop yields, driving higher demand for phosphate-based fertilizers. Further, government measures, including subsidies for fertilizers in India, aid in the expansion of the market. As mature as Europe's phosphoric acid market is, capacity has grown mainly to supply India, a top importer of chemicals in the world. Asia-Pacific, with its rich phosphate deposits, burgeoning industrial economy, and strong agricultural backbone, is likely to dominate the phosphoric acid market worldwide for years to come.

The regions analyzed in this report are:

The market for phosphoric acid is fragmented in nature because with large multinational companies alongside smaller regional producers. In the United States, relatively few companies control production. Interestingly, In 2020, their U.S. operations produced approximately 4.1 million tonnes of phosphoric acid, accounting for about 8% of global annual production and 57% of North America's annual output. This concentration by a few players differs from global production, where many firms produce in different regions, and the market landscape becomes more fragmented. The market shares of these firms are determined by factors such as access to raw materials, technology, and regional demand. Even though dominant companies control parts of the business, the total market is still competitive, and different manufacturers service a range of industrial and farming uses.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages