Practice Management Systems Market Analysis

Explore In-Depth Practice Management Systems Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 11458

Explore In-Depth Practice Management Systems Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

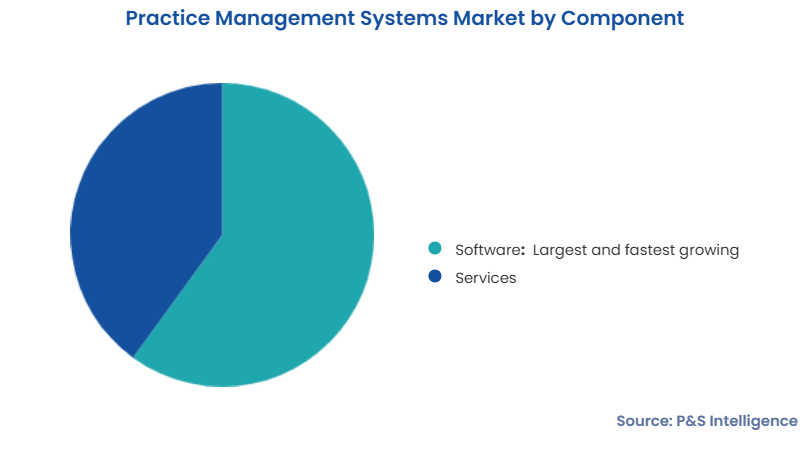

Software held the larger share, of 60%, in the global market in 2024, and it will also have the higher CAGR. The deployment of healthcare information systems is high, with several vendors offering customized software. This reduces workload in medical practice and streamlines workflows, which benefits healthcare personnel by allowing them to discharge their core duties, for improved patient outcomes. It also saves the time spent on activities including checking insurance eligibility, submitting claims, and scheduling appointments.

Moreover, such software helps drive revenue via the streamlining of the revenue cycle management (RCM) process. EHR dashboards help check insurance claim submission, eligibility, rejection, and acceptance. Additionally, the management software provides error- and hassle-free operations. Medical coding also helps ensure proper coding for smooth operations. Additionally, medical management software can allow healthcare professionals to perform claims scrubbing, for quick reimbursement, and reduce errors.

These components are covered:

The cloud-based category is the largest, and it will witness the higher CAGR, of 10%. Cloud-based practice management solutions enable the smooth control of office workflows and invoicing through a customizable dashboard, thus reducing the time spent in producing reports and allowing doctors to spend more time on actually caring for patients. For a better experience, many vendors even integrate these solutions with their own electronic health records.

Additionally, many cloud-based practice management tools allow users to automate various aspects of the business. This can include document management, appointment scheduling, lead generation, job management, and even a client portal where clients can simply upload, download, and read case files or pay invoices.

These delivery modes are covered:

Hospitals held the largest share, of 30%, in 2024 as these solutions enable doctors and office personnel to plan and confirm appointments, as well as managing schedules across different providers, locations, and days of the week. Patients can also book appointments online via many systems. Moreover, these tools allow physicians and other staff members to access not only the basic patient information, such as name, address, phone number, birth date, employer, and insurance provider, but also extensive clinical data, such as medical history, medications, and reasons for previous visits, in a matter of seconds. Hospital administrations can even automatically verify a patient’s insurance coverage prior to their visit.

The system checks bills and claims to ensure they not only adhere to the payor standards but also include the proper diagnosis codes. If the system detects an error or contradicting information that may cause the payment to be delayed, staff personnel are notified so that the issue can be handled. They will also be notified if any claims or patient payments are past due. If the medical practice management system is cloud-based, new billing and procedural codes and rules will be updated immediately, ensuring that the healthcare establishment never employs out-of-date codes.

The physician offices category will grow the fastest due to the increasing number of doctors establishing independent practices. This allows doctors to keep whatever consultation charges and timings they want. Moreover, many doctors work at a hospital by day and then at their independent clinic in the evening, to maximize earnings and provision of care. Independent practices are also beneficial for patients as these places offer more cost-effective and quicker services than the crowded hospitals. Further, the fear of hospital-acquired infections, which burgeoned during the pandemic, continues to push people to their neighborhood clinic rather than a tertiary-care hospital, at least for routine checkups.

These end users are covered:

In 2024, the integrated bifurcation held the larger share, and it is expected to progress at a higher CAGR, of 11% during the forecast period. This growth is mainly attributable to the ability of these products to provide improved patient engagement and better decision making for doctors. These solutions consist of all major tools for managing healthcare practices, including EHRs, e-prescriptions, billing, claims management, and appointments & follow-up scheduling. By bringing all the tools on one dashboard, these solutions save doctors and administrators time in managing patients, thus speeding up care delivery with the ability to serve more patients.

These products are covered:

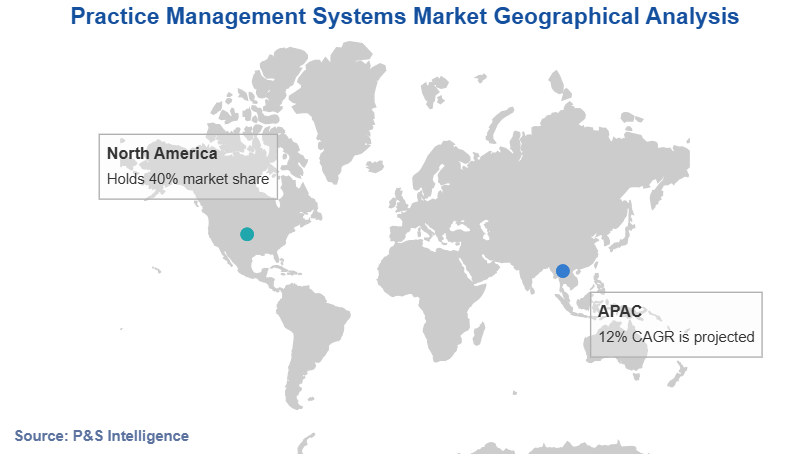

North America accounted for the largest revenue share, of 40%, in the global practice management systems market in 2024. The North American market is expected to continue to maintain its leading position during the forecast period, primarily attributable to the presence of key HIT vendors and the encouraging federal initiatives taken in the region to amalgamate health records on a single platform. Moreover, the increasing awareness of such solutions, coupled with the high government spending on the healthcare sector, is expected to accelerate the growth of the market in the region.

Moreover, electronic medical record adoption among primary-care physicians in Canada is showing continuous growth. All Canadian citizens have at least one clinical report available in the electronic form, which can be accessed by physicians from anywhere. This interoperability of EHR systems is projected to drive the Canadian market over the forecast period.

The APAC practice management systems market will have the highest CAGR during the forecast period, of 12%. The market is driven by favorable government reforms and organizations which provide support to patient engagement solutions, EHR, and e-prescription. Moreover, increasing commercialization of patient engagement solutions developed by the global market players is boosting the market response. Furthermore, the rising need for the development of new systems and replacement and progression of medical infrastructure are expected to provide the market with lucrative growth opportunities over the forecast period.

EHR/EMR adoption has been made mandatory for every patient in India. The Clinical Establishments (Registration and Regulation) Act 2010 made the maintenance and provision of EMR/EHR for mandatory for every patient for registration and continuation of every clinical establishment. Furthermore, upward shift in medical expenditure and ample insurance coverage also contribute to the growth of the regional market.

The practice management systems market in China is expected to grow at a steady rate during the forecast period, owing to the health reforms done by the Chinese government such as the China Health Reform 2009. Moreover, presence of Steering Committee of Health Informatics, which is supported by Ministry of Health in China, is contributing towards the share of the market. This committee focuses on development of Regional Health Information Organizations (RHIO) and use of EHRs.

The regions and countries analyzed for this report include:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages