Russia Residential Energy Storage Industry Insights

Ownership Type Insights

- The utility-owned is expected to grow fastest with a CAGR of 27.8% during the forecast period. The reason behind this is that the ownership of energy generation and storage infrastructure in the country mainly rests with the government.

- Rushydro is one of the largest energy producers in the country with more than 600 facilities, 90 renewable energy facilities, and a total electricity generation capacity of 38.5 GW; a 66% stake of the company is held by the government.

- The customer-owned category holds larger share in 2024.

- The key factor responsible for the dominance of this category is the ability of customer-owned ESS to address the challenges related to overvoltage and imbalance in the energy supply.

- This ownership model gives consumers the power to manage their energy usage more effectively, by ensuring more-stable and efficient energy distribution.

The types of ownerships covered in the report include:

- Customer-Owned (Largest Category)

- Utility-Owned (Fastest-Growing Category)

- Third-Party-Owned

Connectivity Insights

- The on-grid category will have the larger share, of 70%, in 2030. This is because of the increasing popularity of the concept of energy arbitrage, with which residents can integrate energy storage into their solar PV system. Off-peak electricity prices can be utilized to accumulate excess energy, while the on-peak prices can be leveraged to feed it back to the grid for a profit.

- The off-grid category is expected to have the higher CAGR, during 2024– 2030. This would be because of the lack of grid connectivity in more than 10,000 villages across the country and their dependence on high-polluting generators or coal-fired electricity production.

- These are smaller plants, which produce electricity for disconnected villages, where power from main grid does not reach.

- Replacing these highly polluting plants with off-grid ESSs that run on renewable energy can improve economic efficiency and environmental conditions.

Based on connectivity, the following are the bifurcations:

- On-Grid (Larger Category)

- Off-Grid (Faster-Growing Category)

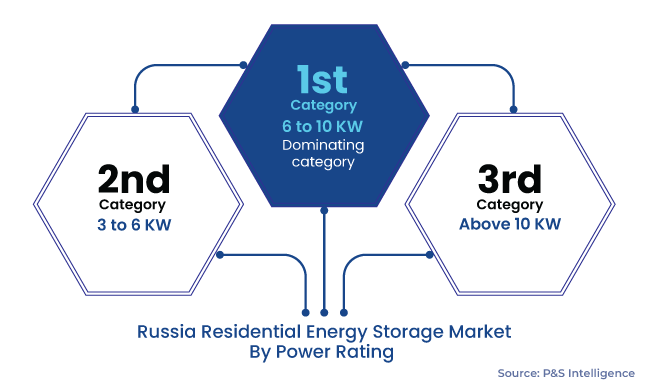

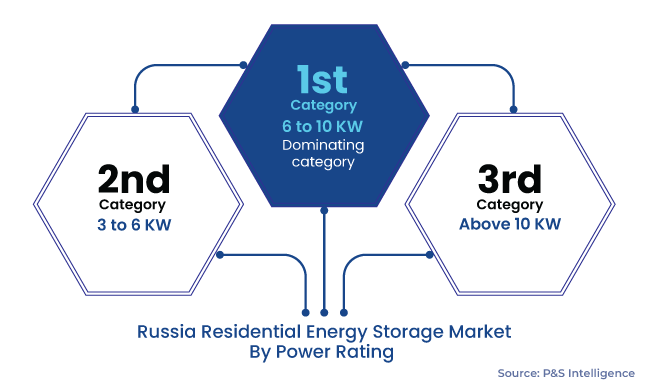

Power Rating Insights

- The 6–10 kW category dominates the market in 2024 with a share of around 50%, and it is also expected to be the fastest-growing category, during the forecast period.

- This will be because of the cost-effectiveness and installation simplicity of residential energy storage systems rated for up to 10 kW.

- The increase in energy consumption, rise in the frequency of long power outages, faults in the grid system, and mounting demand for a greater amount of stable power drive the adoption of 6–10-kW energy storage systems.

During the study, we came across the following power ratings:

- 3 to 6 KW

- 6 to 10 KW (Largest and Fastest-Growing Category)

- Above 10 KW

Technology Analysis

- The lithium-ion category is the larger and the faster-growing, with a CAGR of 27.9% during the forecast period, respectively. The dynamic growth of the category is because such batteries are more reliable and stable and have better energy densities, higher voltage capacities, and lower self-discharge rates, which enhances power efficiency.

- Russia has substantial lithium deposits, and it is actively working toward enhancing its lithium-ion battery industry.

- Rosatom is collaborating with other companies to establish enterprises for lithium extraction and production. Since 2018, LLC Renera (a part of ROSATOM TVEL) has established a portfolio of more than 120 projects for the supply of lithium-ion batteries.

During the study, we analyzed the following technologies:

- Lithium-Ion (Larger and Faster-Growing Category)

- Lead–Acid

Operation Type Analysis

- The standalone category is larger in 2024. The dominance of the category is due to the harsh geological and weather condition in much of the country, especially Siberia.

- The standalone system comes in handy during the time of grid disruption or peak energy demand, acting as a dependable backup power source.

- It is also cheaper and easier to install, operate, and maintain than the one that integrates a solar array.

During the study, we analyzed the two types of operating systems:

- Standalone (Larger Category)

- Solar & Storage (Faster-Growing Category)