Saudi Arabia Heavy Machinery Rental Market Future Prospects

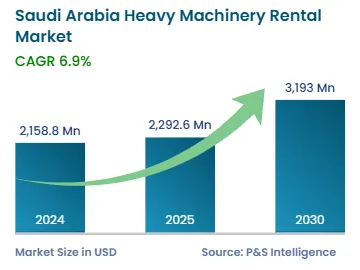

From USD 2,158.8 million in 2024, the Saudi Arabian heavy machinery rental market size is expected to reach USD 3,193.0 million by 2030, at a CAGR of 6.9% between 2025 and 2030. The market is primarily driven by the rampant industrialization and urbanization in the kingdom, propelled by the government measure to diversify its economy. Saudi Vision 2030 aims to reduce the economic dependence of the country on oil and gas by promoting other industries, such as manufacturing, tourism, technology & innovation, healthcare, and education.

Several mega construction projects are underway in several parts of the country, which have not only brought in huge investments from overseas but also provided employment to people. This has been driving the demand for heavy machinery on rent as this approach gives users the flexibility and convenience to use the machinery over the desired period without the hassles of owing it. Several OEMs offer comprehensive service plans for the rented equipment, further saving end users from mobilizing resources for maintenance when they can be engaged in the actual construction.

Further, when owning the machines, it can be cumbersome for users to keep up with the evolving trends, such as electric/hybrid powertrains, engines that burn cleaner fuels, autonomous driving, and V2V/V2I connectivity. On the other hand, companies that rent out such equipment take efforts to follow the latest technological trends in heavy machinery themselves, to make it convenient for customers to use it.