Market Statistics

| Study Period | 2019 - 2030 |

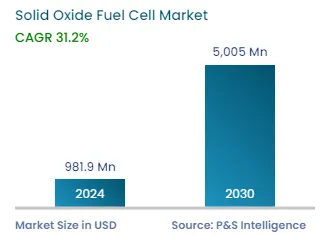

| 2024 Market Size | USD 981.9 Million |

| 2030 Forecast | USD 5,005 Million |

| Growth Rate (CAGR) | 31.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Report Code: 12548

Get a Comprehensive Overview of the Solid Oxide Fuel Cell Market Report Prepared by P&S Intelligence, Segmented by Type (Planar, Tubular), Application (Portable, Stationary, Transport), End User (Commercial & Industrial, Data Centers, Military & Defense, Residentials), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | USD 981.9 Million |

| 2030 Forecast | USD 5,005 Million |

| Growth Rate (CAGR) | 31.2% |

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

Explore the market potential with our data-driven report

The solid oxide fuel cell market size stood at USD 981.9 million in 2024, and it is projected to advance at a compound annual growth rate of 31.2% during 2024–2030, to reach USD 5,005 million by 2030. This is primarily ascribed to the superior efficiency, long-term stability, and fuel flexibility of solid oxide fuel cells, the increasing government subsidies and R&D on fuel cells, the rising need for energy-efficient power production, strict pollution rules and regulations, increased environmental concerns, and the growing emphasis on the utilization of renewable energy sources.

Chemical and material technology advancements are enticing industry participants to use low-cost raw materials and attain low operating temperatures. Additionally, these companies are taking action to reduce manufacturing and operational costs while gaining advantages from the high-energy conversion provided by solid oxide fuel cells. All these factors are responsible for the SOFC market growth.

Additionally, the use of clean energy sources has grown due to the expanding global population and rising energy consumption. With the increasing environmental concerns, governments across the globe are aiming to reduce the consumption of non-renewable energy sources. In an effort to achieve this, stringent regulations for limiting the usage of non-renewable energy sources are being formed, which are leading to the development and adoption of alternative methods to create electricity. The fuel cell technology shows high efficiency in energy generation, owing to which it has a huge application base in stationary power generation. Therefore, such factors are expected to propel the market in the years to come.

Government regulations and support for fuel cells are one of the key driving growth factors for the SOFC sector. For instance, the U.S. introduced several fuel cell programs and offers incentives and support for fuel cell installations, resulting in the high adoption of solid oxide fuel cells and other fuel settings in the country. In addition, fuel cells installed until December 31, 2016, were entitled to a tax reimbursement of USD 3,000/kW or around 30% of the project cost.

Moreover, in the APAC region, China, South Korea, and Japan are some of the well-known nations that are focusing on various applications of SOFCs, such as utility-scale power generation, and offering subsidies for these cells. For instance, in 2019, the Ministry of Industry, the Ministry of Science and Technology, China’s Ministry of Finance and Information Technology (MIIT), and the National Development and Reform Commission together declared subsidies for new fuel automobiles in the country.

Additionally, to build utility-scale energy facilities based on SOFCs, Bloom Energy and its holdings have been collaborating closely with government agencies in South Korea. In addition, two distinct utility-scale power plants with a combined capacity of 19.8 MW and 8.1 MW will be built over the years in two different cities. Similarly, SK E&C (Bloom Energy) and the South Korean government have decided to construct a microgrid based on SOFCs.

Moreover, in September 2021, Bloom Energy unveiled the Hydrogen Energy Server, which can offer on-site hydrogen-powered electricity, and applied solid oxide stacks. This server was tested for 5 months in Ulsan, in alliance with the SK Eco plant (South Korea). These elements are the main causes of the SOFC market expansion in the APAC region.

Countries across the world are shifting from traditional, non-renewable sources toward renewable sources of energy, to reduce their dependency on fossil fuels and keep the environment clean. The regulatory bodies of countries, including the U.S., Japan, and Germany, have framed stringent regulations, to cut down on harmful emissions from several industries, such as power generation, chemicals, and automotive. SOFCs offer several advantages, including high efficiency, fuel adaptability, and extremely low levels of nitrogen oxide (NOx) and sulfur oxide (Sox) emissions. Owing to such factors, the demand for such products is projected to increase from several industries in the coming years, thereby helping the SOFC market grow.

The planar category accounted for a larger revenue share, of more than 60%, in 2022, and it is also expected to hold its position during 2023–2030. This is primarily ascribed to its easy geometry, relatively easier construction procedure, and low-operating cost. Moreover, planar solid oxide fuel cells (SOFCs) are generally planned in a way that the ceramic fuel cell modules are positioned one above the other like a sandwich design with the electrolyte implanted between electrodes, which serve as the most vital components in the manufacturing of these fuel cells.

Additionally, the increasing stringency of government regulations, coupled with a rise in energy prices, is one of the key trends being observed in the planar SOFC market. With the surging awareness of alternative energy sources, combustion-based electricity generators are being replaced by renewable energy systems such as solar panels, which display a higher efficiency in energy conversion. In addition, the fuel cells used in these devices do not cause any harmful emissions, owing to which these are suitable for applications in stationary/backup, transportation, and portable power.

The data centers category accounted for a revenue share, of more than 38%, in 2022. This can be because data centers are highly power intensive and power-consuming, and these required a regular power supply around-the-clock to prevent the loss of important data. As per the IEEE Communications Society, in 2018, electricity requirement from data centers was around 198 terawatt-hours, or almost 1% of the electricity demand globally. Due to the high electricity needs from different establishments of data centers, companies are looking for a way to cost reductions by using distributed power generation, especially fuel cells.

The military & defense category is increasing at a steady growth rate. There is a growth opportunity for SOFCs in this sector, due to the surging demand for efficient and noiseless power production for military applications and the rising portable and stationary power generation by SOFCs. With increased chances for continued expansion in the industry, it is projected that portable SOFCs for military use will increase; and unmanned aerial vehicles and undersea vehicles are also using SOFCs to increase working durations.

Drive strategic growth with comprehensive market analysis

North America held the largest revenue share in 2022, and it is further projected to witness the same trend in the coming years. This is because of the strong support of government policies and initiatives, such as the Department of Energy’s Solid-State Energy Conversion Alliance programs. In the region, the U.S. is a larger and faster-growing market. This is due to the presence of a large number of data centers of major companies, such as IBM, Google, and Equinix, adopting SOFCs; the increased need for fuel cell power generation; tax benefits; and high R&D spending for hydrogen generation.

The European market is projected to grow at a steady growth rate in the forecast period. The growth can be ascribed to the increasing demand for renewable energy production and the rising focus on curbing carbon footprint and deploying hydrogen-based combined heat & power systems. In the region, Germany is one of the top-growing markets for SOFCs. This is majorly due to the structured fuel policies and concrete targets set by the German government. Moreover, the future growth of technologies, related to solid oxide fuel cells, has also been defined in the energy policies.

This fully customizable report gives a detailed analysis of the solid oxide fuel cell industry from 2019 to 2030, based on all the relevant segments and geographies.

Based on Type

Based on Application

Based on End User

Geographical Analysis

The solid oxide fuel cell market size stood at USD 981.9 million in 2024.

During 2024–2030, the growth rate of the solid oxide fuel cell market will be around 31.2%.

Commercial & Industrial is the largest end user in the solid oxide fuel cell market.

The major drivers of the solid oxide fuel cell market include its cost and superior efficiencies, long-term stability and fuel flexibility, increasing government subsidies and R&D on fuel cells, rising need for energy-efficient power production, and strict pollution rules & regulations.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages