Market Statistics

| Study Period | 2019 - 2030 |

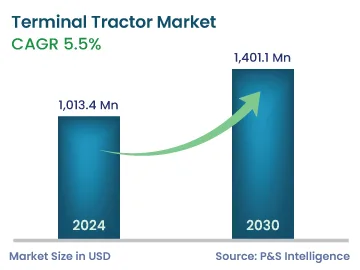

| 2024 Market Size | 1,013.4 Million |

| 2030 Forecast | 1,401.1 Million |

| Growth Rate (CAGR) | 5.5% |

| Largest Region | North America |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Report Code: 12777

Get a Comprehensive Overview of the Terminal Tractor Market Report Prepared by P&S Intelligence, Segmented by Propulsion (Diesel, CNG, Hybrid, Electric), Type (Manual, Automated), Tonnage (Less than 50 Tons, 50-100 Tons, More than 100 Tons), Axle (4x2, 4x4, 6x4), Model (On-Road, Off-Road), Application (Airport, Marine, Oil & Gas, Warehouse & Logistics, Food & Beverages, Rail Logistics), and Geographic Regions. This Report Provides Insights From 2019 to 2030.

| Study Period | 2019 - 2030 |

| 2024 Market Size | 1,013.4 Million |

| 2030 Forecast | 1,401.1 Million |

| Growth Rate (CAGR) | 5.5% |

| Largest Region | North America |

| Fastest Growing Region | Europe |

| Nature of the Market | Consolidated |

Explore the market potential with our data-driven report

The global terminal tractor market size stands at USD 1,013.4 million in 2024, and it is expected to grow at a CAGR of 5.5% during 2024–2030, to reach USD 1,401.1 million by 2030. This is owing to the growth in containerized trade, expansion of ports and logistics hubs, and increase in the demand for efficient cargo handling. Essentially, the growing international trade and emphasis on environmental sustainability drive the demand for electric terminal tractors.

Terminal tractors are class 8 vehicles used to move semi-trailers and shipping containers (loaded or empty) over short distances quickly and efficiently. They are common at warehouses, cargo yards, ports, cross-dock facilities, and truck terminals and can be modified for both off-road and on-road applications. They are known by a variety of names, including yard trucks, yard hostlers, yard jockeys, spotter trucks, and shunt trucks.

The onset of the pandemic affected the market on the global level, with countries experiencing lower incomes, job losses, and hardships. The outbreak of the COVID-19 virus turned into a global pandemic and impacted all business activities, including the production and sale of commercial vehicles. The pandemic disrupted global supply chains, thus causing delays in manufacturing and the delivery of parts and components. Moreover, in 2020, shipments of crude oil, refined petroleum products, and gas together fell by 7.7%, which affected the availability of these tractors, thus leading to potential shortages or delayed deliveries.

However, according to the Review of Maritime Transport released by the United Nations Conference on Trade and Development (UNCTAD), an increase of 3.2% was registered in maritime trade volumes in 2021 from 2020. As international trade grows, there will be a need for infrastructure expansion and upgrades. This will lead to a rise in the for these vehicles to support the handling of larger volumes of goods.

The handling of cargo has now been integrated into the transportation system. The fundamental purpose of all transportation modes is to carry goods between the terminals where they are being prepared for delivery, as well as for movement. Because it serves as the point of goods distribution, packaging, and sorting for their eventual transfer to the final destination via the transportation system, the cargo handling process is crucial in the transportation and logistics chain.

Thus, the growing need for efficient cargo handling operations at ports, terminals, and logistics facilities is driving the market. Ports, which are critical to trade and economic vitality, depend on a wide range of vehicles and machinery to move goods. Due to the increasing volume of cargo being transported around the globe, these tractors play a vital role in streamlining operations, reducing turnaround times, and maximizing the movement of products.

Based on propulsion, electric tractors will hold the largest share in the coming years, mainly due to the rise in environmental concerns and increase in the price of fuels. The transportation sector is a significant contributor to the worldwide greenhouse gas emissions. According to the United States Environmental Protection Agency, the transportation sector holds the largest share of greenhouse gas emissions in the country. The primary source of transportation-related greenhouse gas emissions is the combustion of fossil fuels in cars, trucks, ships, trains, and airplanes.

As the global efforts to combat climate change intensify, industries are seeking ways to reduce their carbon footprint; hence, these alternatives hold a high demand growth potential. Electric tractors offer a cleaner alternative to traditional diesel-powered variants, as the former produce zero tailpipe emissions.

Furthermore, EVs typically have lower operating costs compared to their diesel counterparts. Electric tractors have fewer moving parts, require less maintenance, and benefit from the lower electricity costs compared to those of diesel fuel. Over their lifespan, these cost savings can be significant. Therefore, they are being actively used by a number of businesses, such as ports, freight transporters, and supermarkets, to support their specific use cases and cut carbon emissions. For instance, in April 2023, Autocar LLC, which is a manufacturer of severe-duty vocational trucks, announced that it has begun supplying Walmart with a fleet of battery-electric terminal tractors.

Based on type, the manual category dominates the market, and it is expected to register 5.6% CAGR in the coming years. Manually driven terminal tractors are widely used in all major ports worldwide. In addition, they are the conventional kind and have been in use for a long time. As human operators can work around each piece of equipment's flaws or deal with exceptions in operational procedures, manual terminal tractors can function even when their machines are not in perfect working order. Moreover, because of their industrial use, they must undergo routine maintenance to guarantee proper condition.

The automated bifurcation is expected to witness the faster growth over this decade. An autonomous tractor is a specialized vehicle that is used to transport containers within a terminal. It uses a variety of software and sensors to navigate its environment and avoid obstacles. Moreover, they can be operated 24x7, without any break, which helps improve the efficiency of terminal operations. Further, because they do not require a human operate, he risk of injuries is lower with them.

The 4X2 axle category holds the largest share, of 50%, in the market in 2023. This is mainly due to the rising demand for two-wheel-drive vehicles at ports and terminals as they are more fuel-efficient than 4X4 variants. In addition to this, they are easier to use and require less maintenance than others. Therefore, their usage is rapidly increasing in developing countries, such as Brazil, India, and China.

Moreover, mega and jumbo trailers can only be handled by 4x4 tractors as they have an all-wheel-drive propulsion system, which can support a heavy load. However, due to their expensive nature and frequent requirement for maintenance, they do not have a substantial market in the Asian region. However, in wealthy nations, such as Germany, France, the U.K., and the U.S., the demand for them is increasing due to the need for heavy-load-carrying vehicles.

Drive strategic growth with comprehensive market analysis

Geographically, Europe will witness the fastest growth over the forecast years, with a CAGR of 6.0%. The market in the continent is mainly driven by the presence of numerous players who operate through expansive dealer and distribution networks, including Konecranes, MAFI Transport-Systems GmbH, and MOL CY.

Moreover, with the rise in the adoption of technologies such as automation and the expansion of automated terminals across Europe, productivity will increase. For instance, the Netherlands' ECT Delta, which has been in use since the early 1990s, was the first automated terminal in the world. The HHLA CTA Terminal in Hamburg, Germany, is another such facility in this region.

With the rising rate of urbanization, cities are seeing increasing congestion and limited space for maneuvering large vehicles. These freight carriers are well-suited for these environments due to their compact size and easy maneuvering. According to an article, 85% of the people in Europe live in urban areas. In addition to this, since they offer access to trade and transportation, natural resources, and recreational activities, coastal areas have long been major contributors to economic prosperity. Therefore, the maritime industry continues to be crucial to the economy and society at large, with high hopes for future expansion.

Furthermore, due to these tractors' usefulness in logistics and distribution handling, OEMs have a tremendous opportunity, as the growth of the e-commerce sector has increased the demand for warehouses and distribution centers.

North America held the largest market share over the historical period due to the presence of large industries on the continent. According to the National Institute of Standards and Technology, in 2021, manufacturing contributed USD 2.3 trillion to the U.S. GDP, amounting to 12.0% of the total. Industrial manufacturing is directly dependent on these automobiles. According to the North American Council for Freight Efficiency’s report, approximately 25,242 terminal tractors are operational in the U.S. and Canada. Additionally, if all the terminal tractors in the U.S. and Canada were electrified, emissions would reduce by 929,687 metric tons of CO2 each year.

Moreover, a rising number of manufacturers in the U.S. are actively investing in new equipment, as many countries are facing labor shortages in the logistics and transportation industry. These automobiles help address this issue by reducing the need for human laborers for moving and positioning trailers and containers. For instance, Orange EV is expanding into the Canadian market, driven by the claimed strong financial and operational benefits of its electric yard truck fleets.

This fully customizable report gives a detailed analysis of the terminal tractor market from 2019 to 2030, based on all the relevant segments and geographies.

Based on Propulsion

Based on Type

Based on Tonnage

Based on Axle

Based on Model

Based on Application

Geographical Analysis

The key market players are launching new models and engaging in an increasing number of collaborations with others.

For instance, in June 2023, Kramer Group, Terberg, and StreetDrone jointly deployed autonomous yard trucks across multiple locations at the Port of Rotterdam.

In March 2021, TICO entered into partnerships with Cummins and Volvo Penta to launch its electric terminal tractor in North America.

In May 2021, Autocar LLC launched an emissions-free, all-electric model of its Autocar ACTT terminal tractor, the E-ACTT. It meets the regulatory mandates implemented on the vocational truck industry to reduce fuel consumption by 24% by model year 2027 and, in California, to transition from diesel trucking fleets to zero-emission ones.

The market for terminal tractors will grow by 5.5% between 2024 and 2030.

The size of the terminal tractor industry will be USD 1,401.1 million in 2030.

The manual type currently sells more in the market for terminal tractors.

Electric propulsion is trending in the terminal tractor industry.

The highest revenue in the market for terminal tractors is produced by North America.

Europe is the best region for investing in the terminal tractor industry.

Warehouse & logistics applications dominate the market for terminal tractors.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages