Market Statistics

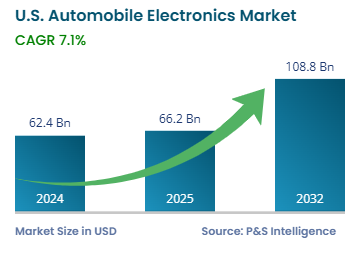

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 62.4 Billion |

| 2025 Market Size | USD 66.2 Billion |

| 2032 Forecast | USD 108.8 Billion |

| Growth Rate (CAGR) | 7.1% |

| Largest Region | South |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13440

This Report Provides In-Depth Analysis of the U.S. Automobile Electronics Market Report Prepared by P&S Intelligence, Segmented by Component (Electric Control Unit, Current Carrying Device, Sensor), System (Engine Electronics, Transmission Electronics, Chassis Electronics, Passive Safety Sustem, Driver Assistance System, Entertainment System, Electronic Integrated Cockpit System), Vehicle (Passenger Car, Commercial Vehicle), Distribution Channel (Original Equipment Manufacturer, Aftermarket), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 62.4 Billion |

| 2025 Market Size | USD 66.2 Billion |

| 2032 Forecast | USD 108.8 Billion |

| Growth Rate (CAGR) | 7.1% |

| Largest Region | South |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. automobile electronic market was valued at USD 62.4 billion in 2024, and it is estimated to grow at a CAGR of 7.1% from 2025 to 2032, reaching USD 106.8 billion in 2032.

The key drivers for the market are the rising population, rampant urbanization, surging disposable income of people, and escalating demand for passenger and freight transportation. All of these factors propel the demand for commercial and passenger automobiles of all kinds.

Electric and hybrid vehicles are gaining popularity because of emission laws and environmental awareness. Their sales drive the market as they need numerous electronic parts to regulate power distribution and battery systems. The International Energy Association reports 14 million electric car sales in 2023, with 95% of these vehicles sold in the U.S., Europe, and China.

The market is also growing because consumers now want better safety features, connectivity, and greater fuel efficiency. ADAS, ABS, lane assistance, cruise control, and autonomous driving functions depend on advanced electronic components. Their integration has become essential due to the rising consumer demand for style and safety; hence, all major car manufacturers include them in their vehicle lineups. Even the affordable vehicle segment today includes infotainment systems for location, direction, entertainment, and other functions.

The government has implemented the Clean Air Act (CAA) to control automobile pollution through vehicle emissions tracking, leading to an increasing demand for electronic components. The exhaust system contains electronic sensors that monitor emissions before their release. The real-time measurement of CO2, CO, and NOx pollutants is made possible by these sensors to enhance efficiency levels.

Electric control unit is the largest category, with a revenue share of 35% in 2024. The ECU serves as the brain of the vehicle, controlling a major proportion of its functions, including engine management, braking, ADAS, infotainment, and climate control. An average car today can have anywhere between 40 and 100 ECUs depending on how feature-rich it is. EVs and plug-in hybrids are further driving the demand for ECUs since they depend substantially on them for battery management, motive power, and charging.

Components studied in the report:

Engine electronics dominate the segment with 25% revenue share in 2024. Engine electronics optimize engine control, performance, fuel efficiency, and emission control. The growing stringency of the government regulations about fuel efficiency and carbon footprint drives manufacturers to enhance their vehicles through these ECUs.

Systems analyzed in the report:

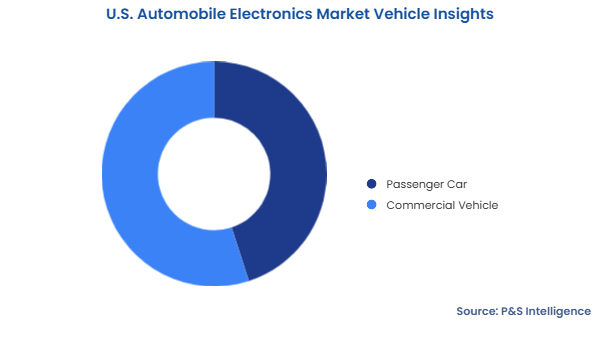

Commercial vehicle is both the larger and faster-growing category, with 55% revenue share in 2024. The U.S. Department of Transportation reported that commercial vehicle sales reached 9,455,000 units in 2021, while passenger vehicle sales stood at 2,376,000 units. This dominance is the result of rising e-commerce, logistics, and supply chain operations in the U.S., which require commercial vehicles equipped with advanced electronic components to support ADAS, navigation, cruise control, and other functions. The growing number of electric commercial vehicles in the fleet further pushes the demand for automotive electronics.

Vehicles analyzed in the report:

The OEM category is the larger, with 70% revenue share in 2024. This is because the electronics that are installed in the vehicles are not easy to manufacture, as they require high levels of expertise in R&D and production capabilities. It is, therefore, not possible for the aftermarket suppliers to provide these products without proper knowledge. Moreover, these components are pre-installed by the OEMs at the time of manufacturing.

Distribution channels analyzed in the report:

Drive strategic growth with comprehensive market analysis

The South is the largest and the fastest-growing regional market, with 35% revenue share in 2024. This is because of its established automotive production sector in Texas, Alabama, and Tennessee. Advanced vehicle technologies are rising in demand within the region because most vehicles are sold in this region. The region is also receiving significant investments from car companies and suppliers, who benefit from business-friendly conditions, reduced costs, and state financial benefits. Southern states are also witnessing increasing EV adoption rates, expanding EV charging networks, and rising semiconductor R&D.

Regions covered in the report:

The automotive industry maintains fragmentation because NVIDIA Corporation, NXP Semiconductors, Continental AG, and many other players focus on separate automotive elements, which include semiconductors, ADAS systems, and infotainment technologies. The wide range of products and continuous technological developments by businesses keep any individual corporation from attaining market control.

Prominent automotive technology companies, including Denso Corporation, Valeo SA, and Robert Bosch Engineering, specialize in separate aspects from automotive safety to connected car technology. The market remains fragmented because both big international firms and specialized companies operate together. The changing technologies and customer preferences generate non-stop modernization, which drives competition in the market areas.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages