Market Statistics

| Study Period | 2019 - 2032 |

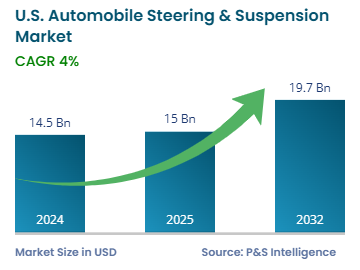

| 2024 Market Size | USD 14.5 Billion |

| 2025 Market Size | USD 15 Billion |

| 2032 Forecast | USD 19.7 Billion |

| Growth Rate (CAGR) | 4% |

| Largest Region | South |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13428

This Report Provides In-Depth Analysis of the U.S. Automobile Steering & Suspension Market Report Prepared by P&S Intelligence, Segmented by Component Type (Steering System Components, Suspension System Components), Technology Type (Hydraulic, Electro-Hydraulic, Electric, Active & Adaptive), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Sales Channel (OEM, Aftermarket), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 14.5 Billion |

| 2025 Market Size | USD 15 Billion |

| 2032 Forecast | USD 19.7 Billion |

| Growth Rate (CAGR) | 4% |

| Largest Region | South |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. automobile steering and suspension market size in 2024 was USD 14.5 billion, and it will reach USD 19.7 billion by 2032 at a CAGR of 4.0% during 2025–2032.

The biggest growth drivers for the market are the increasing population, which is continuously moving to cities and is witnessing a rise in its disposable income and changes in its definition of what is ‘essential’. Moreover, with the rapid industrialization and urbanization, the volume of trade is increasing. All these factors, combined, drive the sale of both passenger and commercial vehicles in the country and, in turn, for steering and suspension components.

The rising consumer demand for improved driving quality and enhanced fuel efficiency leads manufacturers and suppliers to use lightweight materials, intelligent suspensions, and steer-by-wire systems. Electric and autonomous vehicle technologies also influence the industry because their systems need accurate electronic control for steering and suspension mechanisms. With such technological progress, OEMs are moving away from hydraulic systems toward electric power steering (EPS) and adaptive suspension systems.

Steering racks & pinions are the leading category among steering components, with a revenue share of 45%, because of the widespread adoption of EPS. Modern passenger and commercial vehicles have EPS because it delivers enhanced efficiency and control, thus improving driving convenience and road safety.

Shock absorbers lead the market for suspension system components with a share of 5%, because they are essential for ride comfort, safety, and handling stability. The demand for advanced shock absorbers among OEMs and aftermarket entities is rising due to the increasing operational life of vehicles and tough road conditions.

The component types Analyzed here are:

The electric category dominates the market with a share of 45% because of its superior fuel efficiency, reduced maintenance needs, and ADAS and semi-autonomous driving compatibility. The EPS technology removes the requirement for power steering fluid, allowing vehicles to achieve better performance, while reducing energy losses in the system. The EPS technology is popular in both passenger and commercial vehicles because it fulfills the expectations for better handling and enables compliance with government fuel efficiency standards. The growing adoption of electric and hybrid vehicles further propels the market in this category.

The technology types Analyzed here are:

Passenger cars dominate the market with a share of 45% because they witness higher production numbers. Moreover, customers seek better safety and enhanced driving comfort, which are enabled by advanced steering and suspension technology. The rising manufacturing of sedans, SUVs, and crossovers propels the adoption of electric power steering and adaptive suspensions. The demand for shock absorbers, struts, and steering components is increasing because consumers service their vehicles more often than they buy new ones and owners maintain their vehicles for longer periods.

The vehicle types Analyzed here are:

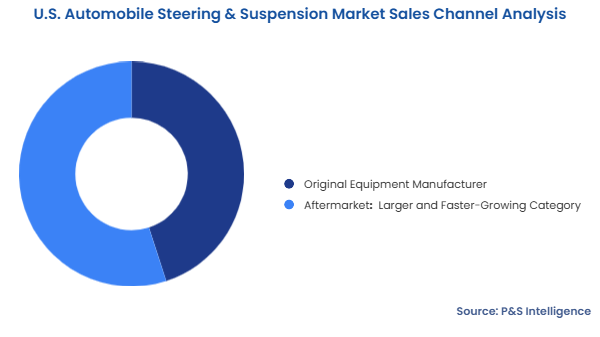

The aftermarket holds the larger share, of 55%, due to growing customer demand for cost-saving repairs versus fresh purchases, alongside an accumulating number of vehicles and their lengthening lives. This continues to propel the demand for shock absorbers, control arms, tie rods, and steering racks, which is majorly fulfilled by the aftermarket. Users and repair shops now have simple access to an extensive choice of aftermarket components at budget-friendly rates on e-commerce platforms.

The sales channels analyzed here are:

Drive strategic growth with comprehensive market analysis

The Southern region leads the market with a share of 45% because of the high vehicle ownership, numerous manufacturing facilities, and vast network of roads. Texas, Florida, and Georgia have a huge number of registered vehicles, which fuels the sale of steering and suspension components. The South witnesses high vehicle maintenance and replacement part sales because its warm weather extends vehicles lifespan. The market growth is also credited to the significant number of automotive production sites and parts distribution centers. The South dominates the market because of the population growth and rise in the demand for freight and passenger transportation.

The Region Analyzed here are:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages