Market Statistics

| Study Period | 2019 - 2032 |

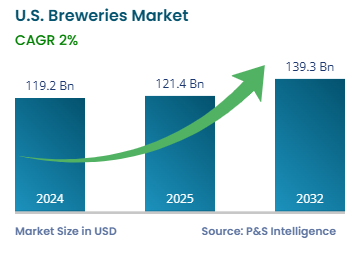

| 2024 Market Size | USD 119.2 Billion |

| 2025 Market Size | USD 121.4 Billion |

| 2032 Forecast | USD 139.3 Billion |

| Growth Rate (CAGR) | 2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13429

This Report Provides In-Depth Analysis of the U.S. Breweries Market Report Prepared by P&S Intelligence, Segmented by Brewery Type (Macrobreweries, Craft Breweries), Beer Type (Large, Ale, Stout & Porter, Malt), Distribution Channel (On-Trade, Off-Trade), Packaging (Bottles, Cans, Kegs), Category (Standard, Premium), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 119.2 Billion |

| 2025 Market Size | USD 121.4 Billion |

| 2032 Forecast | USD 139.3 Billion |

| Growth Rate (CAGR) | 2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. breweries market valued USD 119.2 billion in 2024, which is expected to reach USD 139.3 billion by 2032, growing at a CAGR of 2.0% during the forecast period 2025–2032.

The market is driven by the growing population and its rising disposable income, which lead to higher spending on discretionary items, such as beer and snacks. Moreover, the rich social culture leads to high-volume beer consumption at parties and get-togethers, while the rising peer pressure drives people to consume beer to relax and as an escape mechanism. The high disposable income also leads to the high sale of expensive imported beer from European countries, such as Germany, Ireland, and Belgium, which have a rich beer culture. The craft beer market has matured enough, yet breweries are persistently working to develop new approaches in flavor and brewing methods.

The hazy IPAs provide consumers with the tropical and juicy variants of traditional IPAs, while barrel-aging adds multi-dimensional complexity to standard beer styles. Many consumers want new and specialized seasonal products for more excitement and novelty in their drinking experiences. The inventive brewing techniques produce summer ales and winter brews, which offer something new to existing customers and also attract new ones.

State and federal regulations are being relaxed, which enables breweries to sell their products directly to consumers through online channels and direct shipping services. The elimination of strict regulations provides significant advantages to independent breweries and smaller breweries. These breweries can expand their market reach through direct fan sales while building closer customer relationships.

Macrobreweries are the larger category with a market share of 75%, because the market is controlled by massive production and international distribution capabilities of macrobreweries, such as Anheuser-Busch, Diageo, Carlsberg, Heineken, and Molson Coors. Their market domination results from their enormous production capacity, market recognition, and promotional efforts.

Craft breweries are the faster-growing category with 3% CAGR. Through their innovative approach and premium-quality beers with distinctive local tastes, they successfully draw in customers. Moreover, most microbreweries operate like full-fledged restaurants, offering a huge selection of international flavors and a family ambiance with chic decor and great music.

Here are the brewery types studied in this report:

The lager category is the largest with a market share of 60%, in 2024. Macrobreweries control this category because they produce large quantities of lager and distribute it nationally. People love lagers because they are refreshing and crips in taste and lighter in alcohol content, allowing them to drink more over long periods of socializing.

The ale category is the fastest growing with 2.5% CAGR because people enjoy original tastes, numerous styles, and the special backstories of craft breweries. Ales are characterized by a stronger flavor, which many people in the U.S. prefer. Another reason for the rising popularity of ales is their ability to pair well with a range of food. This is why an increasing number of restaurants use them in beer batters, such as for English-style fish ‘n’ chips, onion rings, mac ‘n’ cheese, and Southern fried chicken.

Here are the beer types studied in this report:

The off-trade channel is the larger category with a market share of 55% in 2024 because most people purchase beer at retail stores and supermarkets for consumption at home. The ease of access and availability across multiple retail outlets enables breweries to make brisk business across the country.

The on-trade channel is the faster-growing category because consumers desire social experiences and premium beer choices. This is why they flock to bars, restaurants, and pubs, where alcoholic beverage prices are way higher than at retail stores. As per estimates, at such establishments, standard beers can be up to thrice as expensive as in retail stores, while premium beers could cost up to 500% as much.

Here are the categories of this segment:

Bottles are the largest category with a market share of 45% in 2024. This is because people perceive bottled beer to be higher in quality than that sold in cans and dispensed out of a keg. Bottles also have a premium look and feel, which allows market players to sell them at higher prices. These containers also offer players a larger surface area for branding and marketing purposes.

Cans are witnessing the highest CAGR, of 3%, due to their convenience, protection from light and oxygen, and eco-friendly design. Cans are lighter and, therefore, more portable than bottles, which enables better on-the-go experiences. Many people buy a large number of cans and stick them in a beer cooler when going on long road trips or having an outdoor party, especially in the summer.

Here are the categories of this segment:

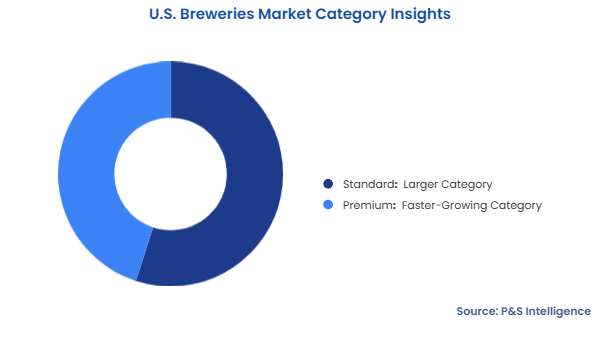

Standard beers are the larger category with a market share of 55% because of their wide distribution and recognizable brand names, which make them trusted options for consumers. They are cheaper than premium beers, which fits with a large chunk of the population of the country.

Premium beers are the faster-growing category with 2.5% CAGR because modern consumers look for distinctive, high-quality experiences. They will buy at a premium price for artisanal flavors and innovative brewing approaches. The category’s growth is also attributed to the rising popularity of imported European beers, many of which fall in the premium category on account of their limited production and richer heritage.

The following categories are studied in the report:

Drive strategic growth with comprehensive market analysis

The West is the largest region with a market share of 45% due to its established craft beer legacy and numerous established breweries in California, Oregon, and Washington.

The South region demonstrates the fastest growth, of 3%, because new breweries are appearing, consumers’ preferences are shifting, and the economy is expanding. Moreover, the huge population of the South is drinking more beer every year, which drives the market in this category.

Here are the categories of this segment:

The market is fragmented because Anheuser-Busch InBev and Molson Coors hold major shares by produce beer on a large scale and selling it through extensive networks. In addition, a huge number of craft breweries have opened in the recent past, giving people new experiences and challenging the dominance of the established players. The U.S. is home to approximately 9,000 craft breweries, which serve targeted consumer bases with distinctive and creative beer offerings. Their marketing through social media and influencers brings people from across the country, who often cover great distances for new tastes.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages