Market Statistics

| Study Period | 2019 - 2032 |

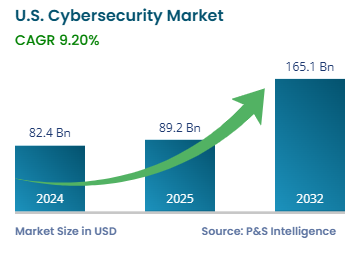

| 2024 Market Size | USD 82.4 Billion |

| 2025 Market Size | USD 89.2 Billion |

| 2032 Forecast | USD 165.1 Billion |

| Growth Rate (CAGR) | 9.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13335

This Report Provides In-Depth Analysis of the U.S. Cybersecurity Market Report Prepared by P&S Intelligence, Segmented by Component (Solutions, Services), Security Type (Application, Network, Endpoint, Cloud, Enterprise), Deployment (On-Premises, Cloud), Enterprise Size (Large Enterprise, Small and Medium Enterprise), Industry (Aerospace & Defense, Government, Banking, Financial Services, and Insurance, Healthcare, Retail, Information Technology & Telecom, Manufacturing), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 82.4 Billion |

| 2025 Market Size | USD 89.2 Billion |

| 2032 Forecast | USD 165.1 Billion |

| Growth Rate (CAGR) | 9.2% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. Cybersecurity market was valued USD 82.4 billion in 2024, which is expected to increase at a CAGR of 9.2% during 2025–2032 to USD 165.1 billion by 2032. The key reasons behind this growth are the rise in the incidence of malware and cyberattacks, the increasing degree of digitization in all aspects of modern life, expanding high-speed internet connectivity, stringent regulations for data security, and people’s surging awareness of the dangers of cyberattacks.

Therefore, a significant amount of an enterprise’s resources is spent on protecting its data and IT infrastructure from attacks such as malware, phishing, and hacking. Additionally, as more businesses adopt cloud computing to reduce their reliance on onsite servers, the need to safeguard that data rises.

One other reason for this is the rise in the number of employees working from remote areas and the implementation of the bring your own device (BYOD) trend in the corporate sector. Companies are at a huge risk of data breaches as sensitive information can be leaked from the personal laptops of employees, which do not have as strong cybersecurity measures as enterprise-issued systems.

Since the COVID-19 pandemic, the work-from-home trend has been continuously growing. As per studies, almost 20% of the U.S. employees worked from home in 2023. Companies allow employees to use their own devices and work from home, which increases the risk of data breaches. Employees are required to access cloud platforms to see and analyze data and share a variety of information.

This creates problems because not only their computer devices but their networks are also not as well protected and, often, completely unprotected, allowing easy access to cybercriminals. In such a scenario, the demand for cybersecurity options, including endpoint protection, zero-trust frameworks, and multi-factor authentication, is rising to address ransomware and malware.

Solutions are the larger category, with 60% revenue, owing to the rising demand for identity and access management, data loss prevention (DLP), and many other cybersecurity solutions. Software makes up the major component of the market, and many services are offered complementarily the first time after the purchase of a software subscription or license.

Services are expected to be the fastest-growing category during the forecast period. Managed services, such as endpoint detection and response, continuous monitoring, threat detection, and risk management are required repeatedly, unlike solutions, which are mostly a one-time purchase. Further, the regular need for software updates and disaster management drives the demand for services at a faster pace.

The components studied include:

Network security is the largest category as regardless of the size of the company, network security is an important component of overall cybersecurity. Since networks are the most often targeted by hackers, countermeasures, such as firewalls and intrusion detection/prevention software, are essential for protecting them.

Cloud security is the fastest-growing category with a CAGR of 10%. This is because companies have started storing their data on the cloud instead of physical databases. Companies use different cloud computing platforms, such as SaaS, IaaS, and PaaS, the protection of which is of the utmost importance and priority.

Security types covered are:

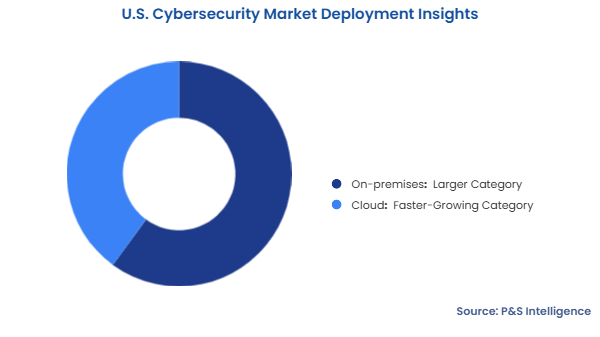

On-premises held larger share in 2024. Many large firms and government organizations prefer on-premises data storage to have full control over access to the databases. Industries such as healthcare, BFSI, and defense, which are bound to stringent regulatory compliance, opt for on-premise storage. Such companies not only need to control access to their software assets but also their cybersecurity tools.

Cloud is the faster-growing because many firms are shifting from on-premises software deployment to getting them over the cloud. This allows firms to be cost-efficient, by providing them with on-demand access and scalability. Moreover, the cloud allows even regional and niche cybersecurity solution vendors to target a larger user base by deploying their solutions on the widely accessible cloud platforms of major IT companies, such as AWS, Microsoft, and Google.

Categories included in this:

Large enterprises are the larger category as enterprises with large-scale and geographically dispersed operations generate large amounts of data. This is why they are always on the lookout for cyberattacks, consequently having strong IT infrastructure to defend themselves against any such incident. They invest in strong network security, endpoint protection, advanced threat detection, and other solutions to protect their as well as their customer's and client’s privacy, save themselves from financial and reputational damage, and comply with the government’s data security regulations.

Small and medium enterprises are the faster-growing category, with 14% CAGR, because these enterprises are falling prey to cyberattacks more often. They chose cost-effective and scalable options, primarily those available on the cloud. These companies make up almost half of the U.S.’s workforce and over 43% of its GDP contribution. Moreover, the more than 33 million SMEs make up over 99% of the companies in the country by number. Their weakly protected IT infrastructure allows cybercriminals to carry out a plethora of malicious activities, prompting these firms to strengthen their security.

These categories are considered:

Banking, financial services, and insurance is the largest category. This industry deals with highly secret information regarding high-value transactions and people’s baking details, which is why it requires advanced cybersecurity solutions. Several regulations subject this sector to compliance, such as NYDFS Part 500, which requires it to implement cybersecurity solutions.

Healthcare is the fastest-growing industry because of rapid digitization, visible in the implementation of electronic health records (EHR) and wearable health trackers connected to the IoT. This creates a huge risk of identity theft and loss of sensitive data, which demands the use of cybersecurity solutions.

Industries under study:

Drive strategic growth with comprehensive market analysis

The West region in the U.S. is the largest with 45% share of the revenue. This is mainly due to the presence of Silicon Valley and Seattle, which drives advancements in cybersecurity solutions. Tech giants, such as Google, Microsoft, and Amazon, which are all headquartered here, both require and offer cybersecurity solutions.

The South is the market with the quickest growth, at a rate of 14%, due to the rise of innovation clusters in Austin and Atlanta. The need for cybersecurity solutions in this region is rising as a result of the expansion of startups and its huge population, with individuals doing more than ever to safeguard their home networks and systems.

Here are the regions covered in the report:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages