U.S. Engine-Driven Welder Market Analysis

Explore In-Depth U.S. Engine-Driven Welder Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

Report Code: 11747

Explore In-Depth U.S. Engine-Driven Welder Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2030

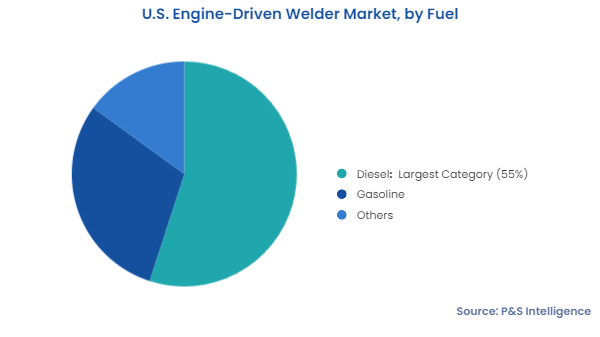

The diesel category holds the largest share, of 55%, in 2024. It will also witness the highest CAGR, of 5.7%, over the forecast period. This can be ascribed to the large-scale adoption of diesel-based engine-driven welders in oil & gas pipeline construction and maintenance works. In addition, diesel is more economical in comparison to gasoline, and it does not ignite as easily as the latter, which makes it suitable for usage in refineries and other industrial facilities.

The following are the categories in this segment:

The 300–399 A category is projected to witness the highest CAGR, of 6.0%, during this decade. It also dominates the market in 2024. This growth can be attributed to their large-scale usage in pipeline, construction, maintenance, repair, fabrication, and structural steelwork applications. In addition, the demand for these variants has witnessed an increase in the agriculture sector for equipment fabrication and repair applications.

The following Ampere ratings have been studied:

The construction category holds the largest share, of 45%, in 2024. The category includes the usage of engine-driven welders for steel structures, and maintenance and repair work. Such equipment offers both welding and power generation capabilities at construction sites, where there is no access to power. In the construction sector, engine-driven welders are used for the removal of scrap metal and the replacement of structural parts. This category is driven by the rampant ongoing construction across the residential, industrial, commercial, and civil sectors in the country.

The pipeline category is likely to progress at the highest CAGR, during the forecast period. This growth can be attributed to the large volumetric demand arising from the oil & gas sector for crude oil transportation. In recent years, companies in the U.S. have been making hefty investments in order to increase oil production. For the transportation of oil produced, the demand for pipelines is expected to increase significantly. This, in turn, is likely to drive the demand for engine-driven welders for welding pipelines in remote areas, with low or no access to power.

The report offers analysis of the following applications:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages