Market Statistics

| Study Period | 2019 - 2032 |

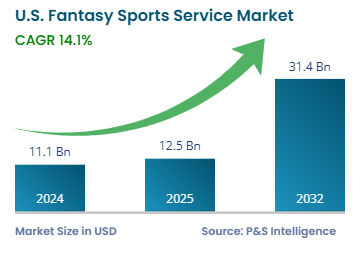

| 2024 Market Size | USD 11.1 Billion |

| 2025 Market Size | USD 12.5 Billion |

| 2032 Forecast | USD 31.4 Billion |

| Growth Rate (CAGR) | 14.1% |

| Largest Region | South |

| Fastest-Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13376

This Report Provides In-Depth Analysis of the U.S. Fantasy Sports Service Market Report Prepared by P&S Intelligence, Segmented by Sport (Individual, Partner, Extreme, Team Sports), Sports Type (Football, Baseball, Basketball, Hockey, Cricket), Pricing Model (Free-to-Play, Pay-to-Play, Subscription, Freemium, Hybrid), Platform (Web-Based, Application-Based), Gameplay (Individual, Team), Device (Smartphones, Computers), Demographic (Under 25 Years, 25 to 40 Years, Above 40 Years), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 11.1 Billion |

| 2025 Market Size | USD 12.5 Billion |

| 2032 Forecast | USD 31.4 Billion |

| Growth Rate (CAGR) | 14.1% |

| Largest Region | South |

| Fastest-Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. fantasy sports service market was valued at USD 11.1 billion in 2024, and it is set to grow at a CAGR of 14.1% during 2025−2032, reaching USD 31.4 billion by 2032. This is because users now have better access to digital activities and mobile technology and because multiple states allow sports betting. The easy access to fantasy sports platforms results from the expansion of fast internet connectivity and growing smartphone ownership. The NFL, MLB, and NBA leagues have built partnerships with fantasy sports providers, which strengthen market trust while expanding its public presence.

The legal nature of online sports betting in several states fuels market development by introducing fresh revenue opportunities and enhancing participation in the industry. Through investments from tech firms and investors, combined with the integration of artificial intelligence analytics and real-time data capabilities, the market continues to advance. Several major generate revenue from subscription fees, advertising income, and sponsorship programs.

Team sports is the largest category with around USD 5.0 billion in revenue in 2024. Popular team sports, such as NFL Fantasy Football, NBA Fantasy Basketball, and MLB Fantasy Baseball, are hugely popular because of the long-standing popularity of the actual leagues. These sporting events attract vast fan bases because of their lengthy seasons with intense engagement, which meets all the requirements fantasy sports need to thrive. Team sports continue to dominate the fantasy sports market due to major platform investments to offer diverse competitions and betting choices.

Sport types studied in the report:

Football is the largest category in revenue in 2024 because of the massive fan base for the NFL, which swells even more around the annual Super Bowl. Larger participation in fantasy football leagues occurs because of NFL popularity and increased interest in football during the active season. The prolonged existence of fantasy football, with its deep American roots, leads to dominance of this sport in fantasy leagues.

The sports covered in the report:

Pay-to-play is the largest category with 40% revenue in 2024 because it collects substantial revenue through entrance costs and prize allocation. Most people play these games to win money, for which there is an entry fee. There are free games available as well, but they only offer points and no real winnings.

Pricing models analyzed here:

The application-based platform is the larger and faster-growing category, with 14.6% CAGR, driven by the adoption of smartphones to access fantasy sports services easily, anytime, and anywhere. Generally, mobile apps are highly convenient, and they keep users engaged via features such as push notifications, real-time updates, and links to network activities. These induce repeat usage and have sufficiently wooed users, transitioning them away from web-based platforms.

Platforms analyzed here are:

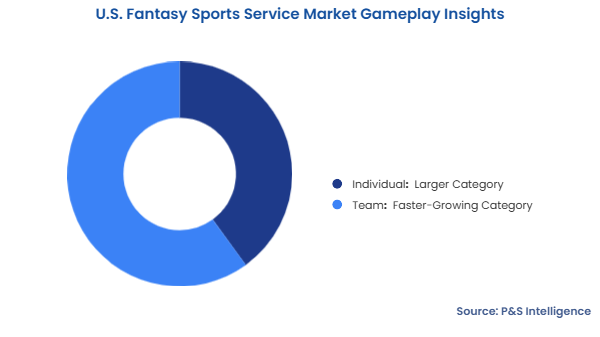

Individual is the larger category with 40% revenue in 2024 because most platforms put individual players against each other, be it in an individual or team sport. The most popular format is the individual-based contest where users compete against each other with their selected lineups. This gameplay exerts its dominance in mainstream sports: football, basketball, and baseball. These contests are simple, flexible, and short-duration (depending on the duration of the actual game), catering to amateur players, even during their free time.

Gameplays analyzed in the report:

Smartphones are the largest and fastest-growing category, because of their availability, usage convenience, and high penetration. The easy availability of high-speed internet, the emergence of numerous fantasy sports smartphone apps, and the ease of participation in them drive their demand. Almost all leading platforms promote a mobile-first experience, enabling live updates and push notifications while allowing transactions to be done within the app.

Devices studied:

The 25 to 40 years category dominates the market in 2024, attributable to their high disposable income, technological proficiency, and intense fervor for sports.

Demographics studied:

Drive strategic growth with comprehensive market analysis

The South is the dominant region with 40% value share in 2024, due to its large population and established sporting culture, particularly in football and basketball. Texas and Florida are large markets with huge support and participation in fantasy sports.

Regions covered during the study:

The market is severely fragmented as in recent years several fantasy sports apps developed in Asia have penetrated the U.S. As there are a variety of sports, so there are a huge range of mobile and web applications for people to indulge in fantasy sports and betting. Software development is already not too financially intensive, which is why the expanding popularity of new sports, specifically cricket, has encouraged many new IT vendors to create fantasy sports applications.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages