U.S. Gas-Insulated Switchgear Market Analysis

Explore In-Depth U.S. Gas-Insulated Switchgear Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 13263

Explore In-Depth U.S. Gas-Insulated Switchgear Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

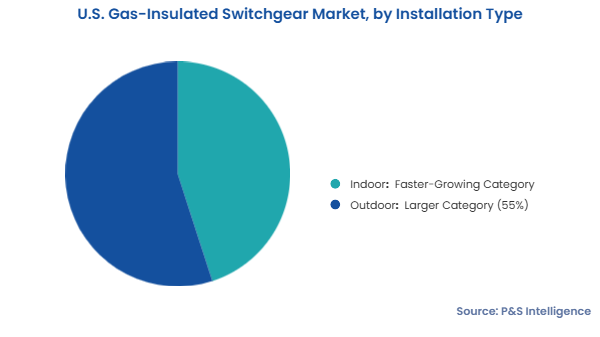

The outdoor category dominates the market with 55% share in 2024. This is credited to the massive electricity requirement of the country, which creates the need for high-voltage T&D. Outdoor GIS installations, especially those with a voltage rating exceeding 66 kilovolts (kV), are ideal for this purpose. Their robustness makes them resilient to harsh weather conditions without extensive maintenance. GIS is also easier to installed outdoors, which is why it is widely used in large substations.

The indoor bifurcation is expected to undergo the faster growth during the forecast period. This will be because of the rampant urbanization in the country, which limits the space for large pieces of electrical T&D equipment. Therefore, indoor GIS is widely installed within buildings or underground, specifically in densely packed urban pockets. GIS designed for indoor usage is also being technologically advanced to offer cost-effectiveness and comply with environmental and noise regulations.

Two installation types are included in this report:

SF6 is the larger category in the market, primarily on account of the high insulation provided by this gas. Additionally, its high dielectric strength enables the system to keep working under high voltages. Further, its arc quenching ability suppresses the electrical arcs that emerge with high-voltage circuits are opened or closed, thus reducing the risk of fire.

The SF6-free bifurcation has the higher CAGR during the forecast period, of 7.3%, driven by the high GWP potential of this gas. To achieve their climate goals, several states in the country have announced stringent limits on SF6 and its plans to phase it out within this decade. In response to these announcements, equipment manufacturers and material science companies are researching other gases that do not cause environmental harm, yet offer the same degree of insulation. For instance, 3M Company offers C4 and C5 as alternative insulating media to SF6 in switchgear.

This segment is divided into two categories:

The above 220 kV category dominates the market in 2024 with around 35% share. Switchgear with such a high voltage rating is widely used in the country for long-distance T&D at low current ratings, which reduces resistive losses. Further, the interconnection of regional grids into one national grid is made possible by high-voltage GIS. Above-200-kW GIS isolates faults and enables the reconfiguration of the grid to keep it stable. These systems are also resilient to adverse weather events, which makes them ideal for areas prone to hurricanes, snow blizzards and tornadoes.

The up to 36 kW category is growing the fastest in the market, majorly due to the worsening space constraints in cities. Additionally, up-to-36-kV GIS is extensively used for medium-voltage applications in buildings and underground substations. It also offers higher safety in critical places, such as data centers, hospitals and offices. GIS with this voltage rating is also rising popularity for its efficiency in integrating clean sources of electricity into the grid and its importance in EV charging stations. It is also used to switch high voltages down at the substation, for use at commercial and residential buildings. This switchgear is also often modular, which enables it to be scaled up or down in response to the power demand.

This segment has four categories:

The largest share in this segment is held by the compact category, which will also witness the highest CAGR, of 7.1%. The high degree of urbanization is the primary driver for the demand for compact GIS as cities have limited space. Compact GIS is also designed to be reliable and robust, so that the power supply remains stable without much maintenance.

This is why these systems are used in hospitals, data centers and other critical facilities where electricity cuts can have disastrous consequences. Here, the encapsulated design of such systems proves advantageous, by reducing the chances of fire and electrocution. Moreover, amidst the environmental concerns, the usage of less SF6 in compact GIS makes it popular, especially in urban areas.

This segment is comprised of four categories:

Power utilities dominate the market with around 40% revenue, and they are also the fastest-growing category. T&D companies use GIS as an essential piece of equipment to distribute high voltages of power reliably and safely over long distances. Since the U.S. witnessed frequent snow storms, hurricanes, wildfires and tornadoes, GIS becomes essential to prevent outages. GIS is also enclosed, which reduces the risk of insulating gas leakage into the atmosphere. The U.S. already has more than 163,000 miles of T&D lines and 15,000 substations, which transmit electricity at up to 230 kV. Moreover, in May 2024, the DoE proposed the laying of 3,500 miles of additional transmission lines across the country.

These end users have been analyzed:

The western region leads the market, generating 35% of the nationwide revenue in 2024. This is attributed to the extensive adoption of wind and solar energy technologies in this region. As per studies, from October 2023 to September 2024, California, Colorado, Nevada and New Mexico produced 44,737 GWh, 22,320 GWh, 16,386 GWh and 18,402 GWh of renewable electricity, respectively. Further, the highly urbanized cities of Los Angeles, San Francisco and Seattle require compact yet reliable T&D systems.

The southern region will witness the highest CAGR during the forecast period. This is attributed to the large population in the southern states, which continues to witness growth. As per the U.S. Census Bureau, the south is the most-populated region, home to 38.4% of all the people in the U.S. The agency also reports that this region is witnessing the fastest population growth in the country, accounting for 87% of the rise in 2023. These states are also witnessing rapid industrialization, and they are the ones most affected by hurricanes, which drives the demand for GIS for grid reliability.

These regions have been studied:

Want a report tailored exactly to your business need?

Request CustomizationWorking with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages