Market Statistics

| Study Period | 2019 - 2032 |

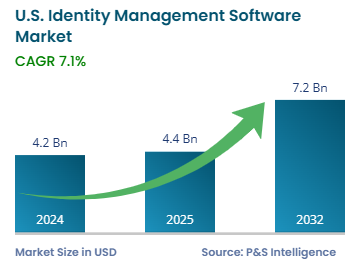

| 2024 Market Size | USD 4.2 Billion |

| 2025 Market Size | USD 4.4 Billion |

| 2032 Forecast | USD 7.2 Billion |

| Growth Rate (CAGR) | 7.1% |

| Largest Region | West |

| Fastest-Growing Region | West |

| Nature of the Market | Fragmented |

Report Code: 13381

This Report Provides In-Depth Analysis of the U.S. Identity Management Software Market Report Prepared by P&S Intelligence, Segmented by Offering (Software, Services), Authentiction Type (Single-Factor Authentication (SFA), Multi-Factor Authentication (MFA), Passwordless Authentication), Deployment (On-Premises, Cloud-Based, Hybrid), Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), Vertical (BFSI (Banking, Financial Services, and Insurance), Healthcare, Government & Defense, IT & Telecom, Retail & E-commerce, Education, Manufacturing & Industrial), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 4.2 Billion |

| 2025 Market Size | USD 4.4 Billion |

| 2032 Forecast | USD 7.2 Billion |

| Growth Rate (CAGR) | 7.1% |

| Largest Region | West |

| Fastest-Growing Region | West |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. identity management software market size in 2024 was USD 4.2 billion, which will reach USD 7.2 billion by 2032 at a CAGR of 7.1% during 2025–2032. This is credited to the rise in cybersecurity threats, stringent regulatory requirements, and increase in the requirement for protected digital service access. Business organizations throughout sectors, including financial services, healthcare, retail, and government, implement identity management solutions for protecting sensitive information, blocking fraud attempts, and making authentication procedures more efficient.

By implementing identity management software, organizations achieve system access control because it enables them to restrict system entry to authorized personnel. Companies are increasingly securing themselves through multi-factor authentication (MFA) as they are adopting cloud-based applications and remote work solutions.

Software leads the market with 75% share because companies need advanced ways to protect their resources both locally and in the cloud. The procurement of IAM tools becomes essential for organizations because they ensure authorized access to critical solutions, while helping businesses satisfy their security compliance requirements.

The services category has the higher CAGR, of 7.5%, because businesses demand experienced experts to understand their intricate identity management requirements and advise on a fit solution. An increasing number of organizations need specialized advice to implement the best identity management solutions due to the rising adoption of the cloud and remote work models. The services enable organizations to uncover their security infrastructure deficiencies, while matching standards and picking the proper software tools to fulfill their requirements.

These offerings are covered

Multi-factor authentication has the largest revenue share, of 65% as organizations want to protect their systems amidst the rising risk of cyberattacks and inadequacy of passwords to offer protection. MFA solutions unite authentication factors, which include something the user knows, such as passwords; and something the user has, such as receipt-enabled smartphones and biometric characteristics unique to the user. MFA minimizes unauthorized access, thus protecting sensitive data in the financial, healthcare, and government sectors.

The authentication types analyzed here are:

The cloud-based category leads the market \ and it is also the fastest-growing, with 7.7% CAGR, because organizations need flexible, scalable, and cost-effective identity management tools. Organizations benefit from cloud-based deployment by obtaining simplified infrastructure, which enables them to expand identity management capabilities for delivering secure access to distant workers. Real-time updates from cloud-based solutions enable organizations to stay ahead of developing cyber threats. The rising hybrid and multi-cloud use drives the market in this category.

The deployment types analyzed here are:

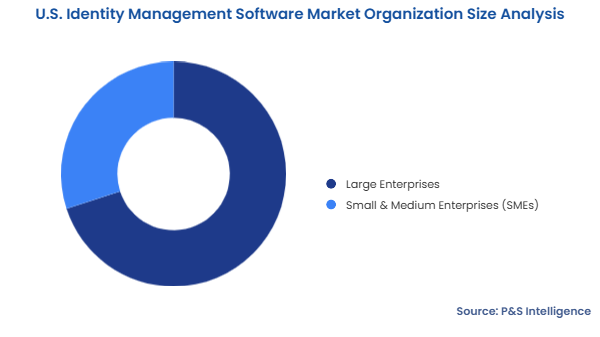

Large enterprises dominate the market because they need extensive secure solutions to control user access across different departments and locations. The advanced nature of their operational requirements forces them to seek identity management systems that can be easily modified and integrated into their existing framework. They work with large volumes of data and are burdened by complex regulatory requirements. They use identity governance & administration, privileged access management, and multi-factor authentication to ensure compliance while managing security risks through streamlined access control.

The organization sizes analyzed here are:

The BFSI sector leads the market with a share of 55%. because financial institutions must secure their highly sensitive information, while adhering to strict regulatory mandates. Financial institutions choose MFA, IGA, and PAM solutions to provide secure access and maintain standards-based compliance to PCI-DSS and SOX. The growing sophistication of cyber threats makes BFSI organizations focus on identity security measures to safeguard customer data and their internal systems.

The verticals analyzed here are:

Drive strategic growth with comprehensive market analysis

The West region dominates the U.S. market with 40% revenue. The region hosts many technology businesses, startups, and established enterprises that dedicate substantial funds to digital innovation, while building powerful identity management systems. The major tech center of Silicon Valley leads in the adoption of state-of-the-art cloud identity management features, multi-factor authentication, and identity governance solutions to protect confidential data. The strong presence of Okta, Ping Identity, and Salesforce, along with other major players, raises the need for innovative identity solutions. The Western region benefits from the remote work transition because distributed systems require scalable and secure identity management solutions.

The regions analyzed here are:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages