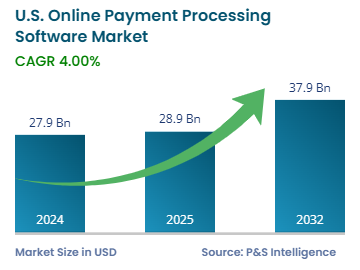

Market Statistics

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 27.9 Billion |

| 2025 Market Size | USD 28.9 Billion |

| 2032 Forecast | USD 37.9 Billion |

| Growth Rate (CAGR) | 4% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13401

This Report Provides In-Depth Analysis of the U.S. Online Payment Processing Software Market Report Prepared by P&S Intelligence, Segmented by Payment Method (Credit & Debit Cards, Digital Wallets, Bank Transfers, Cryptocurrency Payments, Buy Now, Pay Later (BNPL)), Functionality (Payment Gateway Solutions, Merchant Account Services, Point of Sale (POS) Integration, Recurring Billing & Subscription Management, Fraud Detection & Security), Business Size (SMEs, Large Enterprises), Deployment Model (Cloud-Based (SaaS), On-Premises, Hybrid), Transaction Type (Domestic payments, Cross-Border Payments), vertical (BFSI, Government And Utilities, Telecom, Healthcare, Real Estate, Retail, Media And Entertainment, Travel And Hospitality), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 27.9 Billion |

| 2025 Market Size | USD 28.9 Billion |

| 2032 Forecast | USD 37.9 Billion |

| Growth Rate (CAGR) | 4% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. online payment processing software market size in 2024 was USD 27.9 billion, and it will reach USD 37.9 billion by 2032 at a CAGR of 4.0% during 2025–2032. Online payment processing software allows consumers and businesses to complete seamless transactions in services, retail, commerce, and more industries. The demand for secure, fast, and user-friendly payment solutions is rising with the increase in the use of online shopping, subscription-based models, and mobile payments.

Payment processing software is a medium for money transfer between financial institutions, merchants, and buyers. Businesses require efficient payment systems to process the transactions made through credit cards, digital wallets, bank transfers, cryptocurrency, and buy now, pay later (BNPL). Payment processing software from PayPal, Adyen, stripe, and Square provides protection from fraud and support for multiple currencies and sales channels.

Credit & debit cards dominate the market with 45% share because of their extensive usage and verified reliability. Online payments mostly depend on Visa, Mastercard, American Express, and Discover, which have a huge combined customer base. As per studies, while at least 80% of the adults in the country have a credit card, up to 90% have a debit card.

The payment methods analyzed here are:

Payment gateway solutions lead the market with 35% revenue as they authorize and secure payment communications among merchants, banks, and customers. Stripe, PayPal, and Authorize.net are the leading payment gateways as they provide smooth interfaces for e-commerce operations, mobile applications, and subscription-based services. The expanding number of digital businesses implementing scalable API payment gateways drives the market in this category.

The functionalities analyzed here are:

Large enterprises hold the dominating share, of 70%. These companies which include major retailers’ financial institutions and global corporations need advanced payment solutions having sophisticated security tools along with compliance requirements for dealing with high-volume transactions across multiple currencies. Fiserv together with Worldpay (FIS) and Adyen serves large enterprises through enterprise-level payment solutions which manage bulk deal processing, fraud protection, and channel integration.

The business sizes analyzed here are:

Cloud holds the largest share, of 55%, as it offers flexible scalability, affordability, and easy integration into enterprise workflows. Businesses of all sizes and from all sectors, including SMEs and e-commerce platforms, depend on Stripe, Square, PayPal, and similar payment processing service providers to obtain API integrations, automatic updates, and reduced startup expenses. Subscription-based, digital-first business models and cloud-based solutions enhance transaction security, fraud detection, and payment processing capabilities. The incorporation of BNPL and digital wallet functionalities is simpler in cloud platforms, which enhances customer experience and boosts sales conversions.

The deployment models analyzed here are:

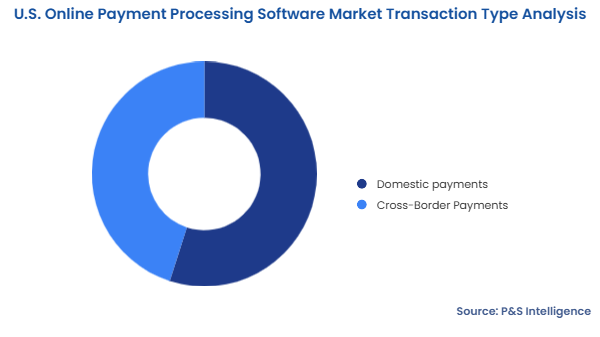

Domestic payment transactions dominate the market with 55% revenue because of an extensive consumer demographic and advanced payment methodologies, including credit cards, digital wallets, and bank transfers. PayPal‘s Square and Stripe provide end-to-end payment solutions for both businesses and their customers. The acceptance of these low-cost payment methods makes domestic transactions attractive for merchants and clients who use credit/debit cards along with ACH transfers. The rise of e-commerce, remote payment technologies, and mobile wallets encourages domestic transactions because they are simple and secure.

The transaction types analyzed here are:

Retail is the leading vertical with a share of 40% because of the fast-growing e-commerce business, omnichannel retailing, and digital-first retail approaches. Online checkouts, mobile payments, and BNPL options are widely popular, forcing retailers to integrate payment processing solutions in their operations. As per the U.S. Census Bureau, Americans bought goods worth USD 308.9 billion online in the fourth quarter of 2024, and this value was 2.7% more than the third quarter.

The verticals analyzed here are:

Drive strategic growth with comprehensive market analysis

The West is the leading region with a share of 45%. Silicon Valley stands as the leading technology hub in the country, home to fintech companies, tech startups, and large e-commerce players. The people here are tech-savvy, which is why they were the first in the country to pivot toward online payments.

The regions analyzed here are:

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages