Market Statistics

| Study Period | 2019 - 2032 |

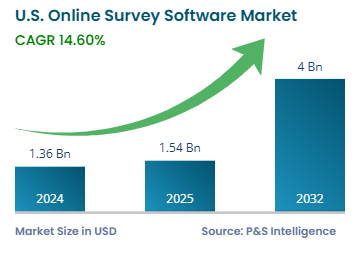

| 2024 Market Size | USD 1.36 Billion |

| 2025 Market Size | USD 1.54 Billion |

| 2032 Forecast | USD 4.00 Billion |

| Growth Rate (CAGR) | 14.6% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13414

This Report Provides In-Depth Analysis of the U.S. Online Survey Software Market Report Prepared by P&S Intelligence, Segmented by Deployment Type (Cloud-Based, On-Premises), Survey Type (Customer Experience Surveys, Employee Feedback Surveys, Market Research Surveys, Product Feedback Surveys, Academic Research Surveys, Political & Social Opinion Surveys), Enterprise Size (Small & Medium Enterprises, Large Enterprises), Pricing Model (Subscription-Based, One-Time Licensing, Freemium Model), Survey Methodology (Web-Based Surveys, Mobile App Surveys, Email Surveys, SMS Surveys, Social Media Surveys, Embedded Website Surveys), Tool (Conversational UI, In-App Feedback, AI-Powered), Industry (Retail, Consumer Goods, & E-Commerce, Education, Healthcare, Travel & Hospitality, Government & Public Sector, Market Research, BFSI, Media & Entertainment), and Geographical Outlook for the Period of 20

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 1.36 Billion |

| 2025 Market Size | USD 1.54 Billion |

| 2032 Forecast | USD 4.00 Billion |

| Growth Rate (CAGR) | 14.6% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. online survey software market size in 2024 was USD 1.36 billion, and it will reach USD 4.00 billion by 2032 at a CAGR of 14.6% during 2025–2032. The market is booming because businesses and research organizations are using digital tools for feedback, customer satisfaction evaluation, and market research purposes. Real-time insights from the customer base, employee teams, and general public are easily obtained via survey platforms. This is important in today’s world because companies make their decisions based on data. Such tools from Google Forms, Qualtrics, SurveyMonkey, and Medallia have become more effective with the addition of AI analytics, automation, CRM, and marketing tools.

Multiple sectors, including retail, finance, healthcare, and technology, execute extensive surveys to monitor customer sentiment, for better organizational decisions. Survey tools integrated with AI analytics, automated reporting features, and CRM integration are essential for corporations to boost customer experience and workforce productivity. Enterprise survey solutions play a key role in data-driven strategies because of their scalability and advanced capabilities.

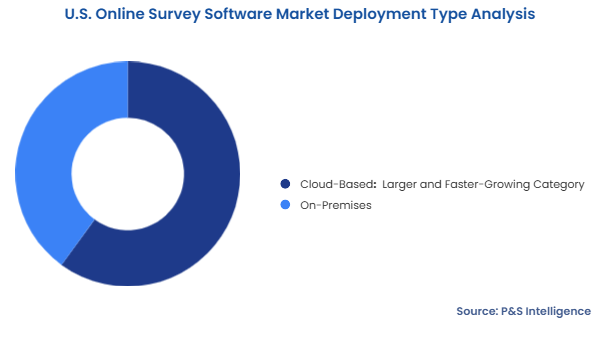

The cloud-based category leads the market with 60% share, and it also has the higher CAGR, of 16%. This is because companies value its scalability, flexibility, and cost-effectiveness. Both small and large businesses use cloud solutions because they offer convenient access, instant teamwork, CRM, and analytics. This category is growing because of the rise in the popularity of mobile surveys, trend of remote work, need for AI insights, and enhancements in them.

The deployment types analyzed here are:

The customer experience category leads the market with 40% share, and it also has the highest CAGR, of 15.5%, as they direct more attention to customer satisfaction and retention efforts. The retail & e-commerce, BFSI, and travel & hospitality industries widely conduct CX surveys to collect sentiment data and maintain net promoter scores through real-time assessments.

The survey types analyzed here are:

Large enterprises are the leading category with 65% revenue because they require advanced analytic functions, AI capabilities, and large-scale survey solutions for customer feedback and employee management. Large businesses choose cloud-based survey tools because these tools enable easy integration with CRM, marketing automation, and business intelligence systems.

The enterprise sizes analyzed here are:

The subscription model controls the market with 65% revenue and 14.5% CAGR because businesses seek solutions that are scalable, cost-effective, and regularly updated. SaaS solutions with AI-driven analytics and automation capabilities, have made annual or monthly subscriptions more desirable than the traditional one-time licensing model. This business model is popular because it enables adaptability, minimal initial investments, and sustains regular platforms for surveys and data analysis.

The pricing models analyzed here are:

Web-based surveys are dominant with 35% revenue because they deliver simple usage, reach wide audiences, and are budget-friendly. Businesses, researchers, and government organizations prefer web platforms to acquire feedback from extensive groups of customers, employees, and market participants. Web-based survey software provides customization options, integrates with CRM and analytics systems, and delivers AI-based analytical capabilities.

The survey methodologies analyzed here are:

AI-powered tools lead with 45% revenue and 16% CAGR because clients want sophisticated analytics, automated systems, and instantaneous information delivery. Through sentiment analysis, prediction tools, and response classification, these platforms enhance user survey results. Business operations are migrating away from the standard, previous-generation surveys toward AI-based systems for customized inquiries and pattern recognition, which create useful conclusions. With this technology companies can easily enhance market research, employee engagement, and customer experience with reduced human intervention.

The tools analyzed here are:

The retail sector had the largest revenue in 2024, of 30% because these companies need marketing-driven feedback and customized shopping interfaces to optimize customers’ experiences. Major retail and e-commerce brands rely on survey engines to monitor customer satisfaction rates, track NPS, and analyze consumer behavior patterns. As per studies, compared to 267.83 million in 2024, 316.63 million people in the U.S. will shop online in 2028.

The industries analyzed here are:

Drive strategic growth with comprehensive market analysis

The West is the leading region with 55% share due to the presence of major technology hubs, including Silicon Valley, Seattle, and Los Angeles. Many giants across industries are based in this region, which drives the demand for survey software with AI-driven analytics, automation, and customer experience tools. The regional concentration of technology companies, startups, and digital business operations creates a strong market need for sophisticated survey technology. The market research, e-commerce and SaaS industries in the West act drive the volume of surveys.

The regions analyzed here are:

The market is fragmented as it has multiple players who serve various companies and specific customer requests in diverse business sectors. Freemium models and custom SaaS platforms create more competition by enabling small startups and specialized providers to enter the market successfully. The increasing customer experience and employee feedback solution demand will keep market fragmentation and promote innovation. A lot of companies based in other countries, especially China and India, create a wide variety of survey platforms.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages