Market Statistics

| Study Period | 2019 - 2032 |

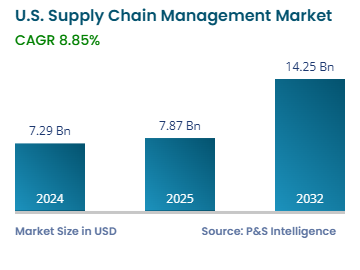

| 2024 Market Size | USD 7.29 Billion |

| 2025 Market Size | USD 7.87 Billion |

| 2032 Forecast | USD 14.25 Billion |

| Growth Rate (CAGR) | 8.85% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

Report Code: 13319

This Report Provides In-Depth Analysis of the U.S. Supply Chain Management Market Report Prepared by P&S Intelligence, Segmented by Component (Solution, Services), Deployment Mode (On premises, On Demand/Cloud Based), Enterprise Size (Small & Medium Sized Enterprises, Large Enterprises), Industry (Retail & consumer goods, Healthcare & pharmaceuticals, Manufacturing, Food & beverages, Transportation & logistics, Automotive), and Geographical Outlook for the Period of 2019 to 2032

| Study Period | 2019 - 2032 |

| 2024 Market Size | USD 7.29 Billion |

| 2025 Market Size | USD 7.87 Billion |

| 2032 Forecast | USD 14.25 Billion |

| Growth Rate (CAGR) | 8.85% |

| Largest Region | West |

| Fastest Growing Region | South |

| Nature of the Market | Fragmented |

|

Explore the market potential with our data-driven report

The U.S. supply chain management market valued USD 7.29 billion in 2024, which is expected to increase to USD 14.25 billion by 2032, advancing at a CAGR of 8.85% during 2025–2032.

The major drivers for the market are the rising need for highly visible and transparent supply chains and the expanding retail & e-commerce sector in the country. The U.S. supply chain management market shows robust growth because businesses are pursuing digital transformation as well as strategic diversification, alongside a strong sustainability focus.

The combination of artificial intelligence, machine learning, the internet of things, and big data analytics transforms supply chain management by improving live decision-making processes, operational performance monitoring, and inventory forecasting abilities. Many businesses implemented supply chain resilience mechanisms because of COVID-19 to maintain operations amidst factory closures and movement restrictions. SCM can be made more resilient through backshoring and nearshoring capabilities, which reduce vulnerabilities and enhance reaction capabilities.

Businesses in the country are increasingly using sustainable and ethical supply chain practices for carbon reduction due to customers’ shifting preferences and the existence of stringent federal environmental laws.

The key trend in the market is the integration of advanced technologies, such as IoT, AI, big data analytics, and cloud-based software, to achieve higher agility in SCM. Businesses that adapt quickly to the changing consumer demands and market disturbances preserve their competitiveness by showing immediate responses to market evolutions.

IoT devices integrated with smart sensors and RFID tags are employed to monitor shipment locations in real time. This enables full visibility throughout supply chains, allowing companies to track products continuously and avoid delays.

Similarly, AI-powered predictive analytics systems help in demand forecasting, which results in reduced inventory shortages and adequate stock. It can analyze vast amounts of data to forecast future trends, optimize inventory levels, and help in improving overall supply chain efficiency. By analyzing big datasets, businesses can achieve an understanding of multiple operational aspects of their supply chains. The analysis of big data enables organizations to make strategic choices and detect operational weaknesses, which leads to maximum efficiency in processes. This is of special benefit to the retail & e-commerce, healthcare & pharmaceuticals, manufacturing, and automotive sectors, which generate and study huge amounts of data each day.

Further, through cloud platforms, stakeholders achieve simple data exchange, bringing better inter-stakeholder collaboration and enhanced decision-making. The solutions enable real-time information access and immediate updates from all locations, thus facilitating better coordination and faster responses.

The swift rise of e-commerce platforms and online retail is the most-important growth driver for the U.S. supply chain management market. The U.S. follows China as the largest e-commerce market in the world, driven by the easy access to the internet, high adoption of smartphones, and people’s demand for greater convenience in shopping. According to the U.S. Census Bureau, e-commerce sales in the country in the fourth quarter of 2024 totaled USD 308.9 billion, which was a rise of 2.7% from the third quarter of 2024.

Businesses are optimizing their logistics and distribution networks to fulfill the demands of consumers for same-day or next-day delivery. The implementation of automated warehousing and robotics to ensure fast order processing and delivery is a key aspect of this market driver. Intelligent inventory management systems help businesses keep an optimum inventory while delivering goods according to customer requirements.

Businesses are investing in last-mile delivery solutions, for example, drones, autonomous vehicles, and advanced routing technology, to improve delivery speed and efficiency. E-commerce firms must have an adjustable supply chain infrastructure to meet the fluctuating consumer demands. The focus on effective supply chain management in e-commerce stems from the need for minimizing delivery costs and times, creating superior customer satisfaction, and establishing a competitive advantage.

The growing focus on supply chain resilience is a key opportunity area for market players. The disruptive events of recent times, such as the COVID-19 pandemic and Russia’s invasion of Ukraine, have made it clear that companies must build resilient supply chains. Therefore, businesses are investing in risk management methods and automated equipment to maintain operations during disruptive events. Supply chain visibility enables teams to monitor operations in real-time and make quick decisions. Organizations that adopt multiple supply networks can minimize their dependence on individual suppliers, thus maintaining stability. Users gain better supply chain control by using dependable systems that protect operations, boost customer trust, and fulfill the changing consumer and enterprise needs. Firms that prioritize resilience are able to achieve better market performance, by dealing better with uncertainties.

The larger category in the U.S. supply chain management market is solutions with 60% value share in 2024. The solutions consist of multiple technologies and systems for transportation management, planning & analytics, warehouse & inventory management, procurement & sourcing, and manufacturing execution. They remain essential for the optimal management of supply chain operations, including logistics and inventory, together with procurement and manufacturing. Additionally, AI-integrated solutions, while essential, are expensive, thus generating the majority of the market revenue from their licensing and subscriptions.

The components covered in the report are:

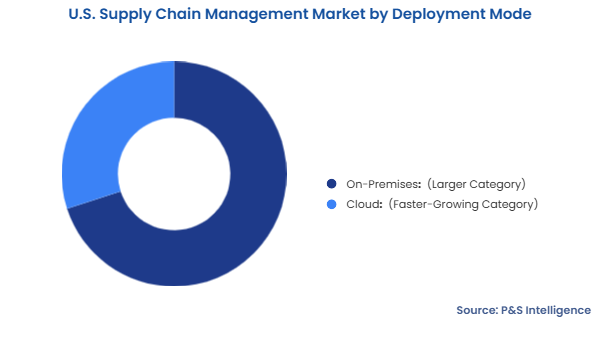

The larger category is on-premises in the U.S. supply chain management market. Users have predominantly relied on on-premises solutions because they enable organizations to maintain control over their systems with enhanced customization and security. The preference for on-premises solutions remains high among large businesses because they want to retain the direct management of supply chain management solutions, while meeting rigid data security requirements.

The cloud bifurcation will witness the higher CAGR during the forecast period, of 10.21%. This is attributed to the cost-saving features of cloud-deployed software as it eliminates the need for purchasing, installing, operating, and maintaining expensive hardware on site. Another advantage of the cloud is anytime, anywhere access to computing resources from merely an internet-connected device, such as a laptop or smartphone. Additionally, with the strict regulations in the U.S. for data privacy, such as the HIPAA, HITECH, and California Consumer Privacy Act, cloud vendors are adopting robust cybersecurity measures empowered by AI and ML.

Deployment modes studied in the report are:

The dominant category is large enterprises, with a share of 65% in 2024. Large enterprises have highly complex supply chain operations, which require cutting-edge software for efficient management. Because of their ability to invest significant financial capital, multinational corporations have been the first in the country to procure advanced technologies to maximize the efficiency of their supply chain operations. To operate their business across the globe, large enterprises are integrating advanced management software into their supply chain operations.

Enterprise size studied in the report:

The largest category is retail & consumer goods because this industry handles massive volumes of goods that require management until the final delivery to end consumers. E-commerce expansion has created a substantial demand for better supply chain operations throughout the country. Companies operating in the retail & consumer goods sector must use robust software for inventory management to accomplish order requirements and make efficient deliveries.

The industries covered in this report:

Drive strategic growth with comprehensive market analysis

The western region is the prime revenue contributor to the U.S. supply chain management market, with a share of 40% in 2024. This is because companies in Silicon Valley extensively fund the development of advanced technologies, including AI and IoT. Amazon, headquartered in Seattle, increases the demand for efficient supply chain systems in the region as it ships around the world. Advanced supply chain management solutions are also essential due to the critical role played by the West Coast's major ports, such as those at Long Beach, Tacoma, and Seattle, in facilitating international trade.

These regions are covered:

The U.S. supply chain management market is fragmented due to the presence of a huge number of software vendors catering to companies of all sizes across industries. The development of software does not demand as high investments as manufacturing, which offers opportunities to established firms, as well as emerging ones and startups. Additionally, a large number of companies from Asia offer SCM software to users in the U.S., which is a key reason for the market fragmentation. Further fragmentation occurs on account of the presence of numerous independent IT service organizations. In the same way, the established cloud computing infrastructure in the country allows even smaller IT vendors to easily provide their software to users.

In December 2024, Logility introduced new AI-native capabilities in its SCM solutions: Intelligent Order Response and enhanced Continuous Network Optimization.

In September 2024, Oracle Corporation announced Oracle Fusion Cloud SCM, which enables businesses to create smarter, more-responsive supply chains. The focus of these enhancements is to augment productivity and visibility, using more-advanced technologies, such as AI and ML.

Want a report tailored exactly to your business need?

Request CustomizationLeading companies across industries trust us to deliver data-driven insights and innovative solutions for their most critical decisions. From data-driven strategies to actionable insights, we empower the decision-makers who shape industries and define the future. From Fortune 500 companies to innovative startups, we are proud to partner with organisations that drive progress in their industries.

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages