Wearable Injectors Market Analysis

Explore In-Depth Wearable Injectors Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 10824

Explore In-Depth Wearable Injectors Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

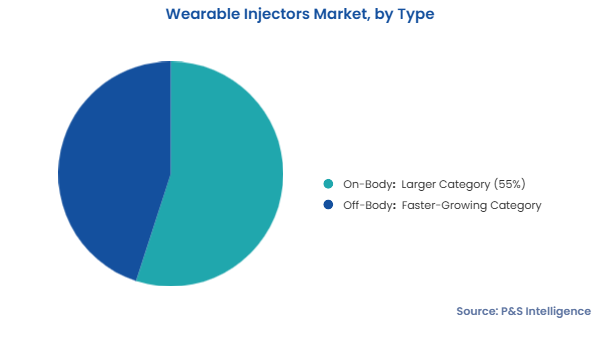

The on-body wearable injector category held the largest wearable injectors market share, of around 55%, in 2024, due to the user convenience and water resistance of such patches.

The body-worn patch injector is attached to the body through an adhesive patch, mostly on the abdomen, for controlled delivery of drugs subcutaneously. It is either preloaded or loaded with the drug at the time of application. Moreover, it is a one-time-use device that can be disposed of once the drug delivery is complete. Additionally, these instruments are easy to use and require no special training. Vendors are marketing their patch injectors either separately or with the drug prefilled. Their rising usage can be credited to the growing urge to reduce healthcare costs, enhance patient care, and increase therapy adherence. Furthermore, the use of such devices leads to a reduction in the number of hospital visits, and they also automatically warm refrigerated drugs.

The off-body belt injectors category will register the highest CAGR, driven by the surging investments for the advancement of off-body injectors. They are placed on the body through a belt cannula, which sticks to the body through an infusion set and a tube attached to the main device. This helps in the controlled delivery of the drug subcutaneously. They are either preloaded or loaded with the drug at the time of application, and they can be used multiple times with different cartridges. The category’s growth is also driven by the prolonged and high-dose delivery required in certain cases and the need to improve patient care and health outcomes. Moreover, these tools eliminate risks including painful device removal, skin adhesion, and skin irritation.

These types are covered in the report:

The spring-based wearable injectors category accounted for the largest revenue share, of around 35% in 2024, and it will also witness the highest CAGR in the coming years. An electronic wearable injector consists of a cartridge loaded with drugs and a drug delivery component, which is operated electronically. The cartridge is made of glass and either prefilled or filled at the time of use. This drug–device combination helps in delivering highly viscous and sensitive biologics. These variants are preferred over syringes by patients looking for convenient and less-frequent dosing in homecare settings.

Moreover, the expanding pipeline of biologics is expected to boost the growth of the market in this category. Patients suffering from chronic diseases, such as diabetes, multiple sclerosis, and hemophilia, require regular administration of drugs. Though electronic technology is costlier as compared to mechanical, hydraulic, and hydrogel technologies, the overall reduced healthcare cost, higher patient comfort, and improved lifestyle are some prospects that are expected to add to the growth. Moreover, these variants have many benefits over auto-injectors and mechanical wearable injectors, for instance, ease of handling, automated delivery, and enhanced safety.

We analyzed these technologies:

The oncology category had the largest share, of around 30%, in 2024. The prevalence of Oncology is increasing globally, and the cost of managing it is already quite high. There are several biologic drugs for Oncology, but they require frequent administration and visits to the hospital or specialized clinic, thus leading to high expenditure and patient discomfort. Wearable injectors are gaining traction among Oncology patients due to the ability they offer to patients to self-administer the drug, thereby improving their lives. Essentially, their feature of automatic and safe delivery of anti-tumor agents acts as a key growth driver for this category.

Diabates is the fastest-growing category, as people suffering from it need regular administration of insulin, often multiple times a day or before every major meal. According to the International Diabetes Federation (IDF), the number of people with this endocrinological condition will reach 783 million by 2045, increasing by a massive 45% from 2021. Since diabetes has a direct correlation with age, wearable injectors could go a long way in improving the quality of life of the elderly. The needle needs to penetrate the skin once, after which, the injector system can be fastened around the waist like a cummerbund. This eliminates the need for individual injections via traditional syringe, thus offering long-term relief from pain.

Here are the applications that were studied:

Homecare accounted for the largest revenue share in 2024, with around 40% revenue share, and it will also expand at the highest CAGR during the forecast period. Homecare setups are convenient and improve the quality of life of patients, by reducing their visits to the hospital. The high prevalence of chronic diseases, increasing demand for self-injection systems, and growing geriatric population are the key drivers for the growth of the homecare category.

The report offers insights into the following end users:

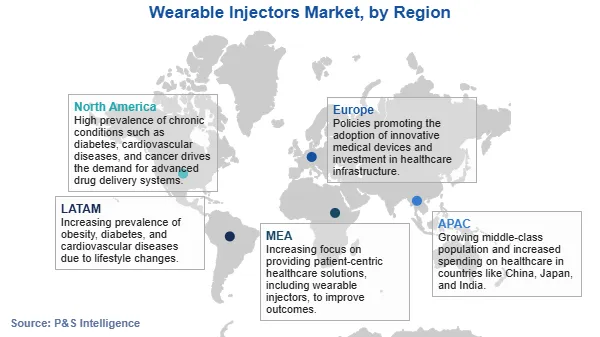

North America garnered the largest wearable injectors market revenue share, of around 35%, in 2024. The extensive biologics pipeline and the increasing burden of chronic diseases are driving the growth of the domain in the region. In addition, the high performance and ease of use of wearable injectors in the case of certain diseases, such as cancer, autoimmune disorders, and hematologic disorders, are expected to increase their usage in the region.

The APAC market is expected to register the highest CAGR during the forecast period, driven by the improving healthcare infrastructure and increasing awareness regarding better healthcare facilities. In addition, the government initiatives in support of the adoption of wearable injectors, rising healthcare expenditure, and increasing geriatric population are propelling the domain growth in the region.

Below is the regional breakdown of the market:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages